filmproducers.ru

Tools

Buying A Vehicle After Lease

If you can acquire the automobile for less than its current market value and you like the car, buying it from the leasing company probably makes financial sense. Every leased vehicle has a purchase option, which is a pre-determined price that the manufacturer has established the car is worth at lease-end. You have the. Determine the buyout amount or purchase price, if available, by looking at your lease and contacting your lessor. · Evaluate the car's wear, tear, and mileage. A lease buyout is when you choose to buy your car at the end of your lease instead of returning it. You can either pay for it in full or finance it with an auto. Many will also charge a penalty for buying out a vehicle early or will apply various transaction fees to process the buyout. Your total buyout price is the. Should You Buy the Car at Lease End? Decision It's generally not a good idea to lease a car if your intention is to buy it at the end of the lease, espeically. The residual value is the estimated value of the car at the end of the lease term. If the car's residual value is lower than its actual value, buying it at the. A car lease buyout occurs when you decide to buy the car you're currently leasing at a pre-determined purchase price. Consider Your Equity: If you have leased a vehicle and think you may want to keep it, you don't have to wait until the end of the contract to negotiate a buyout. If you can acquire the automobile for less than its current market value and you like the car, buying it from the leasing company probably makes financial sense. Every leased vehicle has a purchase option, which is a pre-determined price that the manufacturer has established the car is worth at lease-end. You have the. Determine the buyout amount or purchase price, if available, by looking at your lease and contacting your lessor. · Evaluate the car's wear, tear, and mileage. A lease buyout is when you choose to buy your car at the end of your lease instead of returning it. You can either pay for it in full or finance it with an auto. Many will also charge a penalty for buying out a vehicle early or will apply various transaction fees to process the buyout. Your total buyout price is the. Should You Buy the Car at Lease End? Decision It's generally not a good idea to lease a car if your intention is to buy it at the end of the lease, espeically. The residual value is the estimated value of the car at the end of the lease term. If the car's residual value is lower than its actual value, buying it at the. A car lease buyout occurs when you decide to buy the car you're currently leasing at a pre-determined purchase price. Consider Your Equity: If you have leased a vehicle and think you may want to keep it, you don't have to wait until the end of the contract to negotiate a buyout.

END OF PAYMENTS. You usually just return the vehicle when your lease ends. However, you may be able to purchase it during or after the term of your lease. If not, you should negotiate with the dealer on the purchase price. Account for license and registration fees and Toyota lease buyout fees. If you buy the car. Buy the Leased Car. Some lessees choose to buy the vehicle when their car lease ends. You can pay with cash or finance the purchase with an auto loan. Look. Buying Out Your Vehicle Lease When a lease ends, the lessee can either return the leased vehicle, or buy it from the lessor. If you return the vehicle, the. You can buy out the lease before the contract ends or purchase the vehicle at the end of leasing. Then, you can sell the car once you own it. Used cars in. Your car lease contract will include an estimate of your vehicle's value at the end of the lease term. As your lease ends, you'll have the option to finance. Some drivers fall in love with their leased cars and decide to buy them. Typically, you can buy the leased car at the end of the lease term. The price is. Once your lease is up, you can choose to return the vehicle or purchase it from the dealership. Purchasing a leased vehicle is known as a lease buyout. What is. Should You Buy the Car at Lease End? Decision It's generally not a good idea to lease a car if your intention is to buy it at the end of the lease, espeically. Please note, all remaining payments will become due if the lease is bought-out prior to the maturity date. What happens if my vehicle has damage at the end of. Can you buy a leased car after the initial lease expires? When a lease expires, you can certainly choose to buy the car rather than return it to the dealer. A lease-end buyout allows you to pay the vehicle's price and bring it home for good. This price is determined by what the vehicle is expected to be worth at the. To buy out a lease, you'll need to pay the remaining lease payments and the car's residual value as listed in your lease agreement. For instance, if the car's. It's a good idea to start thinking about your plans for the end of your lease term three to six months in advance. One option is to buy out your lease. In most cases, the dealer will handle the titling and registration of your previously leased vehicle through the MVA. The dealer will provide you with a bill of. How to Buyout a Car Lease · 1. Apply for an Auto Loan. Best Reward Federal Credit Union offers great rates on auto loans that will likely be lower than car. The basic lease buyout definition is when a dealership allows you to purchase a vehicle at or before the end of a lease contract for the price of its remaining. BUYING. Once you've paid off what you owe on your contract, that's it. Your vehicle is % yours. · LEASING. Most people return the vehicle at the end of the. If you've come to love your leased vehicle, a lease buyout will allow you to purchase the vehicle at or before the end of your lease contract for the price of. Do you love your ride so much you don't want to say goodbye? You can purchase your vehicle at any point during your lease. Visit your dealership to discuss your.

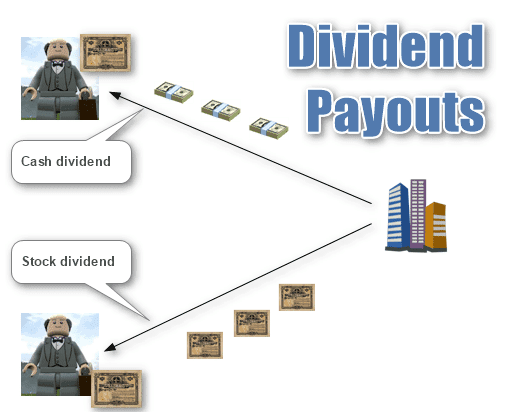

How Are Stock Dividends Paid

Dividends are a percentage of profits that some companies pay regularly to shareholders. · A dividend provides investors income, which they can reinvest if they. common stock should receive their dividend payment within a week after the dividend payable date. If your shares are registered at our transfer agent. Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company will. You get a stock dividend when a company pays you a dividend with extra shares of stock instead of cash. You usually don't need to include these dividends in. Trends that bode well for dividend-paying stocks include historically high levels of corporate cash, relatively low bond yields, and baby boomers' demand for. Usually [an equal or growing amount for each period (eg, monthly/quarterly/annually)], but a lot of stocks pay dividends based on earnings or. Stock dividends are dividends paid to shareholders in the form of shares instead of cash. Companies often choose to pay stock dividends to shareholders when. Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. Essentially, for every share of a dividend stock that you own, you are paid a portion of the company's earnings. You get paid simply for owning the stock! For. Dividends are a percentage of profits that some companies pay regularly to shareholders. · A dividend provides investors income, which they can reinvest if they. common stock should receive their dividend payment within a week after the dividend payable date. If your shares are registered at our transfer agent. Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company will. You get a stock dividend when a company pays you a dividend with extra shares of stock instead of cash. You usually don't need to include these dividends in. Trends that bode well for dividend-paying stocks include historically high levels of corporate cash, relatively low bond yields, and baby boomers' demand for. Usually [an equal or growing amount for each period (eg, monthly/quarterly/annually)], but a lot of stocks pay dividends based on earnings or. Stock dividends are dividends paid to shareholders in the form of shares instead of cash. Companies often choose to pay stock dividends to shareholders when. Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. Essentially, for every share of a dividend stock that you own, you are paid a portion of the company's earnings. You get paid simply for owning the stock! For.

These dividends are usually paid on a quarterly basis, although some companies may opt for a monthly, semiannual, or one-time lump-sum payment. Stock dividends. Dividends can be paid to investors in cash or in additional shares of stock. Typically, dividend payouts are made to investors quarterly, although some. Usually [an equal or growing amount for each period (eg, monthly/quarterly/annually)], but a lot of stocks pay dividends based on earnings or. A common stock dividend is the dividend paid to common stock owners from the profits of the company. Like other dividends, the payout is in the form of. Companies can pay out cash dividends or shares of stock, known as a dividend reinvestment plan (DRIP). A dividend payment is the distribution of a company's profits to its shareholders. Dividends are usually paid in cash but sometimes in company stock. What investments and products pay dividends? Most people think only of stocks when dividends are discussed. While stocks are probably the most common vehicle. Dividends are distributions of property a corporation may pay you if you own stock in that corporation. Corporations pay most dividends in cash. If investors want to receive a stock's dividend, they have to buy shares of stock before the ex-dividend date. The record date is the date the company. which have no voting rights but are given priority in dividend payments—they get paid before any common-stock dividends. Typically the dividend is a fixed. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. If a common stock dividend is paid to holders of preferred stock when there is an accumulated deficit, the dividend should be accounted for at fair value with a. Dividends are payments of cash or additional stock paid out to shareholders of public stocks on a regular basis. When you buy a share (or shares) of a public. A stock dividend, a method used by companies to distribute wealth to shareholders, is a dividend payment made in the form of shares rather than cash. Stock. A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the. The ex-dividend date is set the first business day after the stock dividend is paid (and is also after the record date). If you sell your stock before the ex-. A company offers stocks as dividends by issuing new shares. Typically, the stock dividends are distributed on a pro-rata basis, wherein, each investor earns. When you buy a · The management of a company decides the amount and frequency of dividend payments. · Most companies that pay dividends do so on a quarterly, half. No matter what your stage of life, dividend-paying stocks can be a valuable way to supplement your income and improve portfolio growth potential. Dividends are a portion of a company's earnings that are paid out to shareholders. Some of the most popular shares in the US and UK pay them. Others don't.

Look Up Bond Prices

Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world. Look up the past ten years of data for these series. Access selected data on treasury bill yields. Obtain data on benchmark Canada bonds. Data available as: CSV. Fixed Income Security Lookup. Search on TRACE symbol or CUSIP to find a security and review details including real-time trade history. The bond price is calculated by discounting each semi-annual payment and the face value at maturity back to their present value, using a 3% per period rate. For. Rates & Bonds Asian Marketscategory · Morning Bid: Disinflation dynamics deepen. PM PDT. A man looks at an electronic board displaying the Nikkei stock. Bond prices and volumes · A search and display function for "issuer name" and/or "CUSIP/ISIN codes" that allows users to look up information on trades in. Go to the Yahoo! Bond Center and enter Ford Motor into the "Bond Lookup" tool on the left of the screen; this will bring up a list of Ford Motor bonds. Benchmarks for Bonds Most bonds are priced relative to a benchmark. This is where bond market pricing gets a little tricky. Different bond classifications, as. Get updated data about global government bonds. Find information on government bonds yields, bond spreads, and interest rates. Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world. Look up the past ten years of data for these series. Access selected data on treasury bill yields. Obtain data on benchmark Canada bonds. Data available as: CSV. Fixed Income Security Lookup. Search on TRACE symbol or CUSIP to find a security and review details including real-time trade history. The bond price is calculated by discounting each semi-annual payment and the face value at maturity back to their present value, using a 3% per period rate. For. Rates & Bonds Asian Marketscategory · Morning Bid: Disinflation dynamics deepen. PM PDT. A man looks at an electronic board displaying the Nikkei stock. Bond prices and volumes · A search and display function for "issuer name" and/or "CUSIP/ISIN codes" that allows users to look up information on trades in. Go to the Yahoo! Bond Center and enter Ford Motor into the "Bond Lookup" tool on the left of the screen; this will bring up a list of Ford Motor bonds. Benchmarks for Bonds Most bonds are priced relative to a benchmark. This is where bond market pricing gets a little tricky. Different bond classifications, as. Get updated data about global government bonds. Find information on government bonds yields, bond spreads, and interest rates.

What you get with Bond Analytics. Large sets of analytical output for your consumption. Pricing models are pre-configured with our data. Obviously, a bond must have a price at which it can be bought and sold (see “Understanding bond market prices” below for more), and a bond's yield is the actual. Closing index values, return on investment and yields paid to investors compared with week highs and lows for different types of bonds. This muni bond search and lookup tool features MBIS municipal bond data. Including muni trade data, bids and offers, peer bonds, and price valuations. To find the current value of a bond, enter its series, denomination, and issue date, then click "Calculate." (You need not enter the bond's serial number. But. Let's look at the different types of bonds, starting with the types of The bond can usually be called at a specified price—typically its par value. When interest rates go up, the price of the bond goes down. And when Investors should check the terms of the bond for any call provisions or other. A bond's price is what investors are willing to pay for an existing bond. In the online offering table and statements you receive, bond prices are provided in. Benchmarks for Bonds Most bonds are priced relative to a benchmark. This is where bond market pricing gets a little tricky. Different bond classifications, as. Instrument name · Maturity date · Coupon frequency · Expected coupon payment date · Price · Current yield · Yield to maturity · Accrued days. U.S. Treasury Bonds ; U.S. Rates 3 Months, , % ; U.S. Rates 6 Months, , % ; U.S. Rates 2 Years, , % ; U.S. Rates 3 Years, , %. With our complete list of US treasury bond prices, changes, averages, day charts and news, Yahoo Finance helps you make informed decisions with your money. bonds and other fixed income products Mutual Funds. Top-Performing Funds (1Yr Return). Ticker. NAV. Return. POWERED BY. Quotes delayed at least 15 minutes. Obviously, a bond must have a price at which it can be bought and sold (see “Understanding bond market prices” below for more), and a bond's yield is the actual. Search for domestic and international bonds by country, sector, issuer, currency, volume, placement and redemption dates, yield, duration. Rates ; TMUBMUSD10Y · U.S. 10 Year Treasury Note ; TMBMKDEY · Germany 10 Year Government Bond ; TMBMKITY · Italy 10 Year Government Bond ; TMBMKESY · Spain. In the bond market there is no centralized exchange or quotation service for most fixed income securities. Prices in the secondary market generally reflect. How does changing interest rates affect bond yield and prices? Explore bond investing strategies for different market environments. To determine how to price a municipal bond, the dealer typically first looks at the price it has paid or received for the bond in a recent trade. Sometimes, no. Bond Search Tool. For each product tab below, select your filters and click the View Results button at the bottom of the page to view availability and prices.

How Can You Ship A Car

uShip is here to help. We can connect you with the best car shipping companies Detroit has to offer for a seamless transport experience. We provide both open and enclosed car carrier service through the Pacific Highway crossing. Get your free quote when you call or click on the red “Get Pricing”. The average cost to ship a car across the country, as of , is around $/mile for short distances ( miles) or $ for miles. Car shipping costs. A nationwide car shipping company you can trust. No surprises | Full transparency | Verified carriers. Get an instant quote. miles with average miles a tank st $90/tank is $ plus lodging and $ for food is $ It'll likely be $3k to send the car. Car shipping prices can vary drastically depending on the circumstances, but on average a journey should cost you around $ per mile if the journey is less. Looking for car shipping in Michigan? Find out about procedures, costs, companies, and more. This guide will help you ship your car affordably and fast. Call today to find out how much it Cost to Ship a Car with Easy Auto Ship. We have a dedicated team of well trained individuals for your car shipping needs. Get quotes from trusted carriers, thoroughly vetted and fully insured. Enjoy trackable deliveries, fair pricing, and hassle-free transport from start to finish. uShip is here to help. We can connect you with the best car shipping companies Detroit has to offer for a seamless transport experience. We provide both open and enclosed car carrier service through the Pacific Highway crossing. Get your free quote when you call or click on the red “Get Pricing”. The average cost to ship a car across the country, as of , is around $/mile for short distances ( miles) or $ for miles. Car shipping costs. A nationwide car shipping company you can trust. No surprises | Full transparency | Verified carriers. Get an instant quote. miles with average miles a tank st $90/tank is $ plus lodging and $ for food is $ It'll likely be $3k to send the car. Car shipping prices can vary drastically depending on the circumstances, but on average a journey should cost you around $ per mile if the journey is less. Looking for car shipping in Michigan? Find out about procedures, costs, companies, and more. This guide will help you ship your car affordably and fast. Call today to find out how much it Cost to Ship a Car with Easy Auto Ship. We have a dedicated team of well trained individuals for your car shipping needs. Get quotes from trusted carriers, thoroughly vetted and fully insured. Enjoy trackable deliveries, fair pricing, and hassle-free transport from start to finish.

Depending on vehicle size and carrier type, $ - $1, and upwards of weeks transit time. Car shipping prices can vary drastically depending on the circumstances, but on average a journey should cost you around $ per mile if the journey is less. We're America's #1 Company to Ship a Car Across Country. Damage Free Guarantee* or we help pay! Door to Door Auto Transport Service. % Insured. Licensed and. The average cost for a state to state vehicle shipping company is $ per mile for miles. The cost to ship a car to another state depends on several. When shipping your car cross country, it's essential to choose a reputable and reliable car shipping company. Safeeds Transport Inc is one such. Our complete guide on how to ship your car overseas breaks down the process. If you already know how to ship your car overseas and want to start the process. Calculate your car shipping cost using our free car transport quote calculator and find out how much it costs to ship your car in seconds. Shipping Your Vehicle Overseas · Know the laws and regulations of the United States and the destination country regarding what cars may be imported, and what. AutoStar Transport Express is one of the most trusted auto transport companies in the USA, specializing in car shipping and vehicle transportation. Contact. There is one document that is required for an auto transport – the vehicle condition report, or also known as the vehicle inspection report. This is a document. The fastest way to ship a car across the country is typically by air freight. However, it's also the most expensive option. If speed is a. Need to ship a car from or to Michigan? SGT Auto Transport is one of the top rated car shipping companies in Michigan. Get your free instant quote today! Our advanced network of certified carriers can provide you with safe and reliable door-to-door car shipping service anywhere in the country. As such, probably the fastest way to ship a vehicle is via an open auto transport truck. These are the most common carriers on the road, capable of hauling up. filmproducers.ru provides Car Hauling Companies with end-to-end innovative software solutions that are transforming the auto transport industry. Ship your car, motorcycle, truck or any vehicle nationwide and get it there safely with SAC. Calculate your shipping rate in 3 easy steps! There are plenty of ways to ship a car to another state, so you can find one that works for you, regardless of your needs and your budget. A lot of places don't require you to have the title and registration before you ship a vehicle. It depends on the company you use to ship your vehicle. The main factor, I’ve learned, is the distance. You should expect to pay around $50 per every miles for long distance car transport. The main factor, I’ve learned, is the distance. You should expect to pay around $50 per every miles for long distance car transport.

Pennies That Are Worth A Lot Of Money

Most Valuable Pennies · S "Wheat Penny" · Indian Head Penny · S Wheat Penny · S Wheat Penny. Top 10+ Most Valuable Lincoln Penny Worth Money · 1. D Bronze Lincoln Penny – $1, · 2. Doubled Die Lincoln Penny – $, · 3. S Type II Proof. Top Pennies Worth Money · 1. Indian Head Penny · 2. Indian Head Penny · 3. Indian Head Penny–"L" on Ribbon · 4. S Lincoln. Its auction price from is $45, Also read: 17 Most Valuable Indian Head Penny Worth Money. Rare Wheat Penny Errors List. The San Francisco mint. 10 Most Valuable Wheat Pennies · S: $$ · Doubled Die: $$5, · S: $$ · S Over Horizontal S: $$ · D: $$2, There are six double die obverse Lincoln cents issued during the last 50 years that are worth good money: S, S, , , and. 10 Most Valuable Rare Pennies & Their Fascinating Stories · 1. Birch Cent - About $ Million · 2. Bronze Lincoln Penny - About $ Million · 3. These cents in average condition are worth $$35 while proof coins of this penny can be worth over three grand! 4. Lincoln Cent Struck on Bronze Alloy. The Top Five Most Valuable Pennies Worth Money · 1. D Lincoln Bronze Wheat Penny · 2. Strawberry Leaf Cent · 3. Steel Wheat Penny · 4. VDB Matte. Most Valuable Pennies · S "Wheat Penny" · Indian Head Penny · S Wheat Penny · S Wheat Penny. Top 10+ Most Valuable Lincoln Penny Worth Money · 1. D Bronze Lincoln Penny – $1, · 2. Doubled Die Lincoln Penny – $, · 3. S Type II Proof. Top Pennies Worth Money · 1. Indian Head Penny · 2. Indian Head Penny · 3. Indian Head Penny–"L" on Ribbon · 4. S Lincoln. Its auction price from is $45, Also read: 17 Most Valuable Indian Head Penny Worth Money. Rare Wheat Penny Errors List. The San Francisco mint. 10 Most Valuable Wheat Pennies · S: $$ · Doubled Die: $$5, · S: $$ · S Over Horizontal S: $$ · D: $$2, There are six double die obverse Lincoln cents issued during the last 50 years that are worth good money: S, S, , , and. 10 Most Valuable Rare Pennies & Their Fascinating Stories · 1. Birch Cent - About $ Million · 2. Bronze Lincoln Penny - About $ Million · 3. These cents in average condition are worth $$35 while proof coins of this penny can be worth over three grand! 4. Lincoln Cent Struck on Bronze Alloy. The Top Five Most Valuable Pennies Worth Money · 1. D Lincoln Bronze Wheat Penny · 2. Strawberry Leaf Cent · 3. Steel Wheat Penny · 4. VDB Matte.

14 of the most valuable coins · doubled die obverse Lincoln Memorial cent · D Wisconsin quarter, Extra Leaf Low variety · Sacagawea Cheerios dollar. Pennies Worth Money · D penny · S Lincoln Memorial Cent - Proof - vintage American proof penny · Lincoln Cent Penny - D Mint -. Some examples of pennies worth $1, or more include the Doubled Die Lincoln Cent, the S Indian Cent, the S VDB Lincoln Cent and the D. Top Pennies Worth Money · 1. Indian Head Penny · 2. Indian Head Penny · 3. Indian Head Penny–"L" on Ribbon · 4. S Lincoln. List of 25 Most Valuable US Pennies · 1.) Steel Wheat Penny - $, · 2.) Copper Wheat Penny - $, · 3.) Flying Eagle Penny - $25, · 4.). The Top Five Most Valuable Pennies Worth Money · 1. D Lincoln Bronze Wheat Penny · 2. Strawberry Leaf Cent · 3. Steel Wheat Penny · 4. VDB Matte. 14 of the most valuable coins · doubled die obverse Lincoln Memorial cent · D Wisconsin quarter, Extra Leaf Low variety · Sacagawea Cheerios dollar. Penny With Doubled Die- This coin is a classic example of a subtle error causing an enormous jump in the value. A doubled die occurs when you strike the. Recently, the error wheat penny has gone on auction for over $1 million in uncirculated condition. The price has obviously gone up a lot. The Lincoln Penny holds great significance within the Lincoln Cent collection, renowned for its popularity. Designed by Victor David Brenner, this coin. The Lincoln Head Copper Penny; Double Die Penny; S Lincoln Cent with Double. Valuable Pennies for Sale · Steel Lincoln Wheat Penny, $, · copper Lincoln Wheat Penny, $45, · Flying Eagle penny, $12, – · Indian. Arguably the most valuable one penny coin is the George V penny, which is worth an estimated value of £72, Although this was originally created as a. List of most valuable Wheat Pennies – Auction Records · 1. Bronze Wheat Penny – $60, – $1,, · 2. Steel Lincoln One Cent – $7, – $, · 3. While the Steel Wheat Penny might be the most valuable penny overall, there are other rare pennies that might be worth a search or a. Jun 22, - TOP 2 VALUABLE LINCOLN PENNIES WORTH A LOT OF MONEY!! That being said, unless you have an enormous intake volume of pennies for dirt cheap. You're spending a lot on fuel forming bars, especially if. Pennies are US coins of the smallest denomination worth a cent or $ Count Money with Coins of a Type Game. Play. The Rarest And Most Valuable Pennies (Worth More Than $1 Apiece) ; D penny – $1, doubled die penny – $ ; S penny – $, D close AM penny. A good place to start learning about valuable coins is the Professional Coin Grading Service or Heritage Auctions. When I went through a small pile of old coins.

How Much Is Tax For Stock Gains

Gains arising from sale of stock are taxed at a total rate of % (% for national tax purposes and 5% local tax). Gains arising from sale real. These capital gains may also be subject to the net investment income tax (NIIT), an additional percent tax, if your income is above certain levels. The. You may owe capital gains taxes if you sold stocks, real estate or other investments. Use SmartAsset's capital gains tax calculator to figure out what you. The tax is based on the profit you made — the price you sold it for minus the price you paid — and how long you held onto the asset. The long-term capital gains. General tax questions. Do I have to file a tax return if I don't owe capital gains tax? For the 20tax years, long-term capital gains taxes range from 0–20% based on your income tax bracket and filing status. The calculator on this page. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is based on your taxable income. Just like with ordinary income tax rates, the. The current capital gains tax rates are generally 0%, 15% and 20%, depending on your income. Even a 20% tax “may be a small price to pay for success,” says Joe. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or. Gains arising from sale of stock are taxed at a total rate of % (% for national tax purposes and 5% local tax). Gains arising from sale real. These capital gains may also be subject to the net investment income tax (NIIT), an additional percent tax, if your income is above certain levels. The. You may owe capital gains taxes if you sold stocks, real estate or other investments. Use SmartAsset's capital gains tax calculator to figure out what you. The tax is based on the profit you made — the price you sold it for minus the price you paid — and how long you held onto the asset. The long-term capital gains. General tax questions. Do I have to file a tax return if I don't owe capital gains tax? For the 20tax years, long-term capital gains taxes range from 0–20% based on your income tax bracket and filing status. The calculator on this page. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is based on your taxable income. Just like with ordinary income tax rates, the. The current capital gains tax rates are generally 0%, 15% and 20%, depending on your income. Even a 20% tax “may be a small price to pay for success,” says Joe. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or.

Updated Capital gains tax by state table for each state in the country and D.C.. Capital gains state tax rates displayed include federal max rate at. If you sell stocks, Bitcoin, or a large asset (such as a car, home, or boat) for a profit, you may be on the hook to pay capital gains taxes on that income. These capital gains may also be subject to the net investment income tax (NIIT), an additional percent tax, if your income is above certain levels. The. There are many differences between the federal tax law treatment PA Personal Income Tax Treatment of Stock and Securities Received in a Reorganization. Gains from the sale of collectibles, such as art, antiques, coins, and precious metals, are subject to a higher long-term capital gains tax rate of 28%. Whereas. If you sell a security for more than the original purchase price, the difference is taxable as a capital gain. Gains from the sale of securities are generally. General tax questions. Do I have to file a tax return if I don't owe capital gains tax? Up to $, ($, for married couples) of capital gains from the sale of principal residences is tax-free if taxpayers meet certain conditions, including. With changes in the capital gains tax rates, it is important to understand what capital gain tax is and how it can affect you. Learn more here. Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing status. Your taxable capital gain is generally equal to the value that you receive when you sell or exchange a capital asset minus your "basis" in the asset. Your basis. When you sell a capital asset for more than its original purchase price, the result is a capital gain. This capital gain is taxed differently depending on. Other sold assets will be taxed at long-term capital gains rates. The Federal rates are 0%, 15%, or 20%, depending on filing status and taxable income. Each. When a taxpayer sells a capital asset, such as stocks, a home, or business assets, the difference between the sale price and the asset's tax basis is either a. Capital Gains Tax ; 0%, Up to $44,, Up to $89, ; 15%, $44,$,, $89,$, ; 20%, Over $,, Over $, For tax purposes, when you sell an investment for more than you bought it, you realize a capital gain. This gain is taxable, and the tax rate depends on the. Hawaii taxes capital gains at a rate of %. Idaho. Idaho taxes capital gains as income, and both are taxed at the same rates. The state income and capital. If you are in the 10% or 12% tax bracket, your long-term capital gains tax rate is likely 0%. Be aware that capital gains can push you from one tax bracket to. The Washington State Legislature recently passed ESSB (RCW ) which creates a 7% tax on the sale or exchange of long-term capital assets such as. Essentially, capital gains tax refers to the tax you pay on profits you gain by selling an asset at a higher price than what you bought it for originally.

Is It Cheaper To Fly Or Drive

By myself, flying is cheaper, since I only need one ticket. Think of flying as taking pretty much one whole day, by the time you get to the airport and wait and. Distance and driving time are relative to the city center. Airports are What is the cheapest place to fly from Chicago? You can find cheap flight. On longer trips from a larger airport, it seems it's significantly cheaper to fly – driving is 3x the price and 8x the time! And from the smaller airport. Is it cheaper to fly or drive for your Memorial Day weekend getaway? filmproducers.ru Don't let the economy and rising oil prices stop you from taking your next trip. You can use this tool to find out if it's cheaper to fly or drive to your. Our insurer, 21st Century, grants four waivers a year to students who are attending college elsewhere and who will not be driving a car. When my daughter. You can calculate the cost of getting to the airport and booking a flight versus paying for gas and driving your own car or a rental car. There are lots of. We'll go over the pros of cons of both driving and flying with your pet, the factors you should consider before travel, and why you should consider using pet. For a shorter trip, driving is likely going to be more economical than flying. But for longer, cross-country trips, flying will likely be a much cheaper and. By myself, flying is cheaper, since I only need one ticket. Think of flying as taking pretty much one whole day, by the time you get to the airport and wait and. Distance and driving time are relative to the city center. Airports are What is the cheapest place to fly from Chicago? You can find cheap flight. On longer trips from a larger airport, it seems it's significantly cheaper to fly – driving is 3x the price and 8x the time! And from the smaller airport. Is it cheaper to fly or drive for your Memorial Day weekend getaway? filmproducers.ru Don't let the economy and rising oil prices stop you from taking your next trip. You can use this tool to find out if it's cheaper to fly or drive to your. Our insurer, 21st Century, grants four waivers a year to students who are attending college elsewhere and who will not be driving a car. When my daughter. You can calculate the cost of getting to the airport and booking a flight versus paying for gas and driving your own car or a rental car. There are lots of. We'll go over the pros of cons of both driving and flying with your pet, the factors you should consider before travel, and why you should consider using pet. For a shorter trip, driving is likely going to be more economical than flying. But for longer, cross-country trips, flying will likely be a much cheaper and.

The total time flying will be is 6 hours and 36 minutes or minutes. Compared to flying, driving is 8 hours and 12 minutes or minutes round trip with no. Is it safer to fly or drive? Whether flying is better than driving depends on several factors. We break down your family travel need-to-knows to. Fly Drive - MLB · Holidays That Put You in the Driving Seat · Fly drives do exactly what they say on the tin – you get a flight over the pond and a set of wheels. I prefer to drive around Europe You can see so much more than if you were flying plus there's no rental car fees, no delays or cancellations etc it's way. For a single person in a car, it would be cheaper to fly. With the cost being around starting at at around $ per person from go from. Number of travelers (a car can be cheaper when shared by two or more people) drive on. Other good driving areas are Scandinavia (hug the lip of a. For example, traveling by car is often cheaper and more accessible than traveling by plane. However, when you need to cover long distances in a reasonable. On the other hand, if you're on a tight budget, driving is usually the cheapest option, especially if you have a group splitting costs. Keep in mind, though. Don't let rising flight and fuel costs get you down. Find out how much you could save - or spend - on your trip based on whether you fly or drive. cheap flights, then the price of an airline ticket can be steep. Although oil prices affect both flying and driving costs, their correlation with the price. By myself, flying is cheaper, since I only need one ticket. Think of flying as taking pretty much one whole day, by the time you get to the airport and wait and. Cost-effective: Although flying is generally more expensive than driving, it can be cheaper when renting a car or driving your own. Gas. Using some of the UK's favourite holiday destinations, we've calculated the cost and time difference between flying and driving to our summer breaks. What we. Useful tools to help you find the best deals. Find the cheapest days to fly. The Date grid and Price graph make it easy to see the best flight deals. When planning the costs of driving instead of flying, most people take into consideration the cost of gas and maybe even food when stopping on a road trip, but. Don't let rising flight and fuel costs get you down. Find out how much you could save - or spend - on your trip based on whether you fly or drive. trips cheaper than flying? Here's · a car between late December · cheap (and they're far higher · to drive, especially if you · for lodging en route, it · rent a car. Please note: The drive from Miami International Airport can range from hours-5 hours depending on traffic. . A few questions that must be asked before. Book a fly drive holiday with British Airways Holidays. deposits from £60 per person. Get great deals on flight and car rental packages. ATOL protected. Enter your travel information (dates, car model, number of nights in a hotel while driving, number of hours driving per day, rental car cost at destination.

How To Cash Out Your 401k Fidelity

What Are the Steps to Cash Out a Fidelity (k)? · Step 1: Check Your Plan's Rules and Regulations · Step 2: Determine Your Eligibility for a Withdrawal · Step. The IRS may assess the 10% early withdrawal penalty for a financial hardship distribution if you are under the age of /2. Please indicate your reason for. Steps to withdrawing. · From the "Quick Links" tab, select "Loans or Withdrawals." · Choose the button "See your Options" to review your choices. Early Withdrawal Calculator for (k)s, (b)s or other retirement plans · Calculate the costs of an early withdrawal · What to know before taking funds from a. As a result, there are certain restrictions for borrowing or withdrawing money from your (k) account, particularly as an active team member. If you leave. Your ability to receive payments or withdraw money from your MIT (k) Plan account depends on your age and your current employment status at MIT. For a withdrawal from your Employer-Sponsored Retirement Plan (such as a k or b) Single Withdrawal Request (You will be directed to NetBenefits. (Fidelity), to make the above withdrawal. • If this is a distribution from a Profit Sharing or. Self-Employed (k) Plan, you acknowledge that spousal. Withdrawals from a SIMPLE IRA can be initiated using our separate form (PDF) or by calling us for assistance at You'll have the following choices. What Are the Steps to Cash Out a Fidelity (k)? · Step 1: Check Your Plan's Rules and Regulations · Step 2: Determine Your Eligibility for a Withdrawal · Step. The IRS may assess the 10% early withdrawal penalty for a financial hardship distribution if you are under the age of /2. Please indicate your reason for. Steps to withdrawing. · From the "Quick Links" tab, select "Loans or Withdrawals." · Choose the button "See your Options" to review your choices. Early Withdrawal Calculator for (k)s, (b)s or other retirement plans · Calculate the costs of an early withdrawal · What to know before taking funds from a. As a result, there are certain restrictions for borrowing or withdrawing money from your (k) account, particularly as an active team member. If you leave. Your ability to receive payments or withdraw money from your MIT (k) Plan account depends on your age and your current employment status at MIT. For a withdrawal from your Employer-Sponsored Retirement Plan (such as a k or b) Single Withdrawal Request (You will be directed to NetBenefits. (Fidelity), to make the above withdrawal. • If this is a distribution from a Profit Sharing or. Self-Employed (k) Plan, you acknowledge that spousal. Withdrawals from a SIMPLE IRA can be initiated using our separate form (PDF) or by calling us for assistance at You'll have the following choices.

If you are over age 59½, you may withdraw before-tax funds (excluding your TVA matching funds) from the (k) Plan. You will not pay an early withdrawal. Also, a 10% early withdrawal penalty generally applies on distributions before age 59½ for IRAs and (k)s, unless you meet one of the IRS exceptions. If you. The only other way to get access to your funds is to leave your employer. Disadvantages of Closing Your k. The IRS allows individuals to cash out their k. It is always possible to donate retirement assets, including IRAs, (k)s and (b)s, 1 by cashing them out, paying the income tax attributable to the. If your (k) or (b) balance has less than $1, vested in it when you leave, your former employer can cash out your account or roll it into an individual. Withdrawals of taxable amounts are subject to ordinary income tax, and, if taken before age 59½, may be subject to a 10% IRS penalty. Fidelity Brokerage. To take a cash withdrawal from the Basic Retirement Plan: Contact TIAA () or Fidelity () to request a cash withdrawal or rollover. As if that wouldn't be bad enough—you only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a (k) or IRA. (k) plan services. Stand out with a (k) that offers more. Having the right expertise, tools, and technology can be a game changer for you and your. If you'd like to complete a cashout withdrawal of your (k) funds, select the option to "Request a cash distribution.” Note, this option will result in. You call the account custodian and you ask them what situations qualify for a hardship - withdrawal or loan - and tell them if you have such a. Use this form to make a one-time withdrawal from your nonretirement Brokerage or Mutual Fund Only account. Do NOT use this form. In this article, we will walk you through the process step by step. From understanding the rules and regulations of your plan to calculating the amount you. Participants should call the Fidelity Retirement Service Center at to request a hardship withdrawal. Participants must submit appropriate. You may tap into (k) funds without penalty under certain circumstances. · Those who qualify for a hardship withdrawal can use the money for education. You can withdraw money via check from most non-retirement accounts. On Portfolio Summary, select Withdraw Money from the Select Action drop-down box. 1. Roll over to Fidelity IRA · 2. Roll over to a new workplace plan · 3. Stay in your old (k) · 4. Cash out (and pay taxes). If you have a Fidelity (k) from a previous job, there are a few options for you to consider when doing a rollover. The process for Fidelity — sometimes. For a withdrawal from your Employer-Sponsored Retirement Plan (such as a k or b) Single Withdrawal Request (You will be directed to NetBenefits. Once you. In general, you can borrow up to one-half of your vested account balance (including your contributions, Fidelity National Information Services's potential.

What Are The Odds Of Winning On A Slot Machine

The best slots strategy is to choose a game with a high RTP percentage. Slots with an RTP of 97%+ tend to pay out more over time. Find more of the top RTP slot. In a modern slot machine, the odds of hitting a particular symbol or combination of symbols depends on how the virtual reel is set up. As we saw in the last. It means that if you play perfectly, you have a 47% chance to win in each round. If we add up all rounds during an hour, the chance is down to 23%. If you would. The Ugga Bugga slot machine game has the highest payout percentage, at %. The second highest is Mega Joker by NetEnt, with a 99% RTP. Jackpot by. After the first time, all slot machines' odds of winning will greatly decrease. Getting a $ payout also means acquiring the "Lucky Winner" Achievement/Trophy. > ; Poker, 2 to % ; Lottery, 50% ; Roulette, % ; Slot machines, 8% (average). No matter what casino game you play–slots, craps, blackjack, roulette or any other–games of chance are primarily based on random outcomes and cannot be. The slot machine with the best odds is the $25 machine, but only by a few percent. The best possible odds with the $25 machine using the average numbers for. Betting $1 per spin with a maximum bet of $10, the odds of hitting the grand jackpot (which can range from $10, to $,) are around 1 in 13, Players. The best slots strategy is to choose a game with a high RTP percentage. Slots with an RTP of 97%+ tend to pay out more over time. Find more of the top RTP slot. In a modern slot machine, the odds of hitting a particular symbol or combination of symbols depends on how the virtual reel is set up. As we saw in the last. It means that if you play perfectly, you have a 47% chance to win in each round. If we add up all rounds during an hour, the chance is down to 23%. If you would. The Ugga Bugga slot machine game has the highest payout percentage, at %. The second highest is Mega Joker by NetEnt, with a 99% RTP. Jackpot by. After the first time, all slot machines' odds of winning will greatly decrease. Getting a $ payout also means acquiring the "Lucky Winner" Achievement/Trophy. > ; Poker, 2 to % ; Lottery, 50% ; Roulette, % ; Slot machines, 8% (average). No matter what casino game you play–slots, craps, blackjack, roulette or any other–games of chance are primarily based on random outcomes and cannot be. The slot machine with the best odds is the $25 machine, but only by a few percent. The best possible odds with the $25 machine using the average numbers for. Betting $1 per spin with a maximum bet of $10, the odds of hitting the grand jackpot (which can range from $10, to $,) are around 1 in 13, Players.

Slots machine results are as random as humans can program a computer to be. Odds of the game are set so the house will have an edge; Except in rare cases, slot. Your odds of winning depend on the type of slot machine you're playing, as well as the paylines you choose to bet on. Machines that cost pennies to play might. slot machine game. Sydney Casino Accomodation: Using the Pokies2go Bonus Code. Overall, while the pandemic has certainly impacted the accessibility of. The slots odds of winning are all based on bingo card games odds because of the Oklahoma state laws requires this to be the basis of a winner. Betting $1 per spin with a maximum bet of $10, the odds of hitting the grand jackpot (which can range from $10, to $,) are around 1 in 13, Players. Every slot machine at a casino uses something called a par sheet which provides information about the odds for each tile on a reel. Each reel is weighted to. Odds. The cost of play on slot machines is built into every spin. If the payout is 90% to the customer, then the cost of play. No matter what casino game you play–slots, craps, blackjack, roulette or any other–games of chance are primarily based on random outcomes and cannot be. slot machine game indicates that it is a win. beliefs about the odds of winning at gambling constitute a key risk factor for developing problem gambling. The odds are very low, but you can literally win millions if you hit the jackpot on some progressive payout slot machines. Slot Machine Tips. Here are some. The odds typically range between 50 million to one and up to million to one. But it's important to note that these odds may be higher or lower depending on. Hit frequency is defined as how often a slot machine will have a winning outcome and, like return to player, is usually given a percentage. So a hit. The Slot Machine starts with a base probability of 48% for winning and 52% for losing. These chances can be altered through various means: Hacking the machine. Slots machine results are as random as humans can program a computer to be. Odds of the game are set so the house will have an edge; Except in rare cases, slot. When playing on these machines, there's a possibility that you may win millions of dollars! However, the odds are very, very slim. These machines make the. Are There Any Ways To Increase Your Chances Of Winning On Slots? There is no way to increase your chances of winning on a specific slot game. The odds of. *The slot machine I was playing has just hit. It will not hit again for a long time. FALSE. Each reel spin has the same odds of winning. – or losing – as any. So, as an example, if a game has an RTP of 94% then the theory is that if you put $ into the slot machine then you could expect an estimated return in. For example, a slot with 3 reels that holds 20 symbols per reel would give you a 7, to 1 chance of winning. So, is there any way we can choose slots which. odds against winning a royal flush. The drums could also be rearranged to The winning patterns on slot machines – the amounts they pay and the.

Smart Ways To Invest

12 Smart Ideas to Make Passive Income in Canada Luckily, we've got you covered with a roundup of the best ways to invest in present (and future) you. Best ways to invest your money · Insurance plans · Mutual funds · Fixed deposits, Provident Fund (PF) and small savings · Tax benefits. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit . 12 Smart Ideas to Make Passive Income in Canada Luckily, we've got you covered with a roundup of the best ways to invest in present (and future) you. Treasury bonds and municipal bonds typically offer lower returns but come with less risk. With a bond paying a 2% interest rate, a $1 million investment could. Essential questions · What is your attitude to risk and potential returns? · How long do you want to invest for? · Are you investing for capital growth, income or. Prepare to invest · Develop an investing plan — define your financial goals, risk tolerance and investment time frame. · Research different asset classes —. Dollar-cost averaging may spread the risk of investing. · Lump-sum investing gives your investments exposure to the markets sooner. · Your emotions can play a. Most smart investors put enough money in a savings product to cover an emergency, like sudden unemployment. Some make sure they have up to six months of their. 12 Smart Ideas to Make Passive Income in Canada Luckily, we've got you covered with a roundup of the best ways to invest in present (and future) you. Best ways to invest your money · Insurance plans · Mutual funds · Fixed deposits, Provident Fund (PF) and small savings · Tax benefits. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit . 12 Smart Ideas to Make Passive Income in Canada Luckily, we've got you covered with a roundup of the best ways to invest in present (and future) you. Treasury bonds and municipal bonds typically offer lower returns but come with less risk. With a bond paying a 2% interest rate, a $1 million investment could. Essential questions · What is your attitude to risk and potential returns? · How long do you want to invest for? · Are you investing for capital growth, income or. Prepare to invest · Develop an investing plan — define your financial goals, risk tolerance and investment time frame. · Research different asset classes —. Dollar-cost averaging may spread the risk of investing. · Lump-sum investing gives your investments exposure to the markets sooner. · Your emotions can play a. Most smart investors put enough money in a savings product to cover an emergency, like sudden unemployment. Some make sure they have up to six months of their.

Master the basics · Investment mistakes even smart people make · Understanding long-term investments · Don't raid your retirement funds for cash. What is a high-risk, high-return investment? · Cryptoassets (also known as cryptos) · Mini-bonds (sometimes called high interest return bonds) · Land banking. Types of investments (i.e. stocks, mutual funds, ETFs); Do I want to pay taxes on my investment gains now or when I retire? How do I invest on my own? Do I need. Define Your Goals · Diversify Your Investments · Figure Out Your Finances · Gauge Your Risk Tolerance · Learn About Investment Options · Pay Off Credit Cards or. Setting up automatic contributions into your investment accounts can also make it easier to stick to your plan. And making fixed regular purchases over a long. The unconventional way of buying gold facilitates you to invest in gold in a non-physical form ie, either through paper form or even in non-paper form. There are many savings and investment accounts suitable for short- and long-term goals. And you don't have to pick just one. Look carefully at all the options. 7Understanding Dividends and Growth Rates: Key Factors for Smart Investing Best Way to Invest 10K · WorkshopToolbox · Subscription DisclosurePrivacy Policy. Investing a smaller dollar amount over a long time can have a greater impact on investment results than investing a larger dollar amount for a shorter period. Set investment goals. Identify your most important short-, medium and long-term financial goals. Next, estimate how much each goal will likely cost. It's often. Decide how you'll invest · Buy and sell investments yourself · Use a professional investment manager · Investing with a financial adviser · Invest through your. 5 tips for smart investing · 1. Start investing early. It's said that the early bird gets the worm. · 2. Invest consistently · 3. Build a diverse portfolio · 4. Don. Explore ways to invest in your future. We can help you take control of J.P Morgan online investing is the easy, smart and low-cost way to invest online. You need to decide how much risk you're willing to take when you invest. This will largely depend on your financial goals, how prepared you are to accept losses. Know how your savings or pension plan is invested. Learn about your plan's investment options and ask questions. Put your savings in different types of. Welcome to automated investing, where our robo-advisor can help build and manage your portfolio. Get started. Video: Watch how it works. You want to make your money grow, take control of your finances and make smart investments for a better future? digital way to invest. Investing in. This mix is essentially how much of the various kinds of investments – such as shares, bonds, property or just plain cash – you hold. It's important to find out. Because investors differ in how long they plan to invest and how much risk they are willing to take, SMART also offers preset Static Portfolios ranging from. Young investors have the most valuable resource on their side: time. · Compound interest and dividend reinvestment are proven methods of building long-term.