filmproducers.ru

Overview

Proshares Ultra Oil And Gas

The latest fund information for ProShares Ultra Oil & Gas, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund. Performance charts for ProShares Ultra Energy (DIG - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. DIG | A complete ProShares Ultra Energy exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Performance charts for ProShares Ultra Energy (DIG - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. Get the live ProShares Ultra Oil & Gas (DIG) ETF stock quote, historical prices, returns, largest holdings, expense ratio, and more on Vested. Real time ProShares Trust - ProShares Ultra Oil & Gas (DIG) stock price quote, stock graph, news & analysis. Get detailed information about the ProShares Ultra Oil & Gas ETF. View the current DIG stock price chart, historical data, premarket price, dividend returns. Performance charts for Proshares Ultra Oil & Gas Exploration & Production (UOP - Type ETF) including intraday, historical and comparison charts. This ETF offers 2x daily long leverage to the broad-based Dow Jones U.S. Oil & Gas Index, making it a powerful tool for investors with a bullish short-term. The latest fund information for ProShares Ultra Oil & Gas, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund. Performance charts for ProShares Ultra Energy (DIG - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. DIG | A complete ProShares Ultra Energy exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Performance charts for ProShares Ultra Energy (DIG - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. Get the live ProShares Ultra Oil & Gas (DIG) ETF stock quote, historical prices, returns, largest holdings, expense ratio, and more on Vested. Real time ProShares Trust - ProShares Ultra Oil & Gas (DIG) stock price quote, stock graph, news & analysis. Get detailed information about the ProShares Ultra Oil & Gas ETF. View the current DIG stock price chart, historical data, premarket price, dividend returns. Performance charts for Proshares Ultra Oil & Gas Exploration & Production (UOP - Type ETF) including intraday, historical and comparison charts. This ETF offers 2x daily long leverage to the broad-based Dow Jones U.S. Oil & Gas Index, making it a powerful tool for investors with a bullish short-term.

ProShares Ultra Oil & Gas (DIG) DIG is a passive ETF by ProShares tracking the investment results of the Dow Jones U.S. Oil & Gas Index (%). DIG launched. ProShares is the leader in strategies such as dividend growth, interest rate hedged bond and geared (leveraged and inverse) ETF investing. Research ProShares Ultra Oil & Gas (DIG). Get 20 year performance charts for DIG. See expense ratio, holdings, dividends, price history & more. ProShares Ultra Oil & Gas (NYSE:DIG) is a finance entity engaged in providing leveraged exposure to the oil and gas sector. This company is designed for. ProShares Trust - ProShares Ultra Oil & Gas is an exchange traded fund launched and managed by ProShare Advisors LLC. It invests in public equity markets of the. Best ETFs with ProShares Ultra Oil & Gas Exposure - Find detailed & exclusive ETFs insights at StockTargetAdvisor. Get INDEX:filmproducers.ru financial index information for Proshares-Ultra-Oil-&-Gas-ETF, including index changes, index trading volume, and more. ProShares Ultra Bloomberg Crude OilSM seeks daily investment results, before fees and expenses, that correspond to two times (2x) the daily performance of. The Index includes equity securities of companies from the following GICS industries: energy equipment & services and oil & gas consumable fuels. The Index. ETF information about ProShares Ultra Oil & Gas, symbol DIG, and other ETFs, from ETF Channel. Learn everything about ProShares Ultra Oil & Gas (DIG). News, analyses, holdings, benchmarks, and quotes. Find the latest ProShares UltraShort Oil & Gas (DUG) stock quote, history, news and other vital information to help you with your stock trading and. PROSHARES TRUST. ProShares Ultra Oil & Gas (DIG). ProShares UltraShort Oil & Gas (DUG). PROFUNDS. Oil & Gas UltraSector ProFund (Investor Class ENPIX. Get the LIVE share price of ProShares Ultra Oil & Gas(DIG) and stock performance in one place to strengthen your trading strategy in US stocks. Latest ProShares Ultra Energy (DIG:PCQ:USD) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and. It invests through derivatives in stocks of companies operating across energy, energy equipment and services, oil and gas equipment and services, oil, gas and. Get comprehensive information about ProShares Ultra Oil & Gas (USD) (USG) - quotes, charts, historical data, and more for informed investment. Get INDEX:filmproducers.ru financial index information for Proshares-Ultra-Oil-&-Gas-ETF, including index changes, index trading volume, and more. Direxion Daily S&P Oil & Gas Exp & Prod Bl 2X Shs. $ GUSH %. ProShares UltraShort Energy. $ DUG %. ProShares Ultra Bloomberg Natural Gas. The ProShares Ultra Energy seeks daily investment results, before fees and expenses, that correspond to two times the daily performance of the S&P Energy Select.

New Sewer Line Cost Per Foot

You can expect pipe lining to cost anywhere between $80 to $ per linear foot. There is a wide range in price because the true cost varies from project to. Trenchless sewer line replacement costs · Equipment and skill: $80 and $ per foot · Average cost: $ - $12, for critical sewer repairs. May go up to. It depends on many factors: · If it is roughly 25 ft, no walkway is affected, it might cost somewhere between $ to $ to dug up and replace. The $ excavation cost is based on a $ per foot basis. Since the location is around 5 feet in, they figured 4 feet deep, 5 feet in, and an extra foot. lines. The bursting head splits the old pipe apart while the new pipe is pulled into place. $ -$ per foot. *According to filmproducers.ru National. To replace sewer lines less than 50' long, CostHelper readers paid $5,$6, or $$ per foot for traditional trenching projects, at an average cost of. Digging and replacing a sewer line costs $3, to $25,, or $50 to $ per foot. Trenching costs $4 to $12 per foot and may be a necessity. With the average sewer line repair cost between $50 and $ per foot, most homeowners are paying $ per foot for each repair or replacement needed. If it's. In California, that cost can equal anywhere between $$ per linear foot, with an average of around $ Depth and Accessibility. The depth at which the. You can expect pipe lining to cost anywhere between $80 to $ per linear foot. There is a wide range in price because the true cost varies from project to. Trenchless sewer line replacement costs · Equipment and skill: $80 and $ per foot · Average cost: $ - $12, for critical sewer repairs. May go up to. It depends on many factors: · If it is roughly 25 ft, no walkway is affected, it might cost somewhere between $ to $ to dug up and replace. The $ excavation cost is based on a $ per foot basis. Since the location is around 5 feet in, they figured 4 feet deep, 5 feet in, and an extra foot. lines. The bursting head splits the old pipe apart while the new pipe is pulled into place. $ -$ per foot. *According to filmproducers.ru National. To replace sewer lines less than 50' long, CostHelper readers paid $5,$6, or $$ per foot for traditional trenching projects, at an average cost of. Digging and replacing a sewer line costs $3, to $25,, or $50 to $ per foot. Trenching costs $4 to $12 per foot and may be a necessity. With the average sewer line repair cost between $50 and $ per foot, most homeowners are paying $ per foot for each repair or replacement needed. If it's. In California, that cost can equal anywhere between $$ per linear foot, with an average of around $ Depth and Accessibility. The depth at which the.

On average, homeowners in Minneapolis can expect to pay around $ to $ per foot for sewer line sleeve installation. For example, if you have a damaged. The average cost for replacing a sewer line can vary significantly, with a range starting from $ for basic sewer cleaning to more complex replacements that. On average, installing a sewer line costs between $65 and $ per linear foot. These pipes, typically around 5 inches in diameter, run from your house to the. The average sewer line repair cost in New York City is between $50 and $ per foot. This includes basic materials such as pipe and fittings and labor costs. Depending on pipe materials, running a new sewer pipe costs $50 to $ per linear foot, which includes materials and labor. Your sewer pipes run from the house. On average, this method can cost $$+ per foot. This estimate depends on the length and depth of the existing sewer pipes, ease of access to the pipes, and. Most homeowners pay within the ballpark of $50 to $ per foot, with some cases where it may cost $ per foot. For instance, a foot pipe can cost $ to. The cost to replace a sewer line completely generally costs $50 to $ per foot and can add up to something like $25, A sewer line typically needs. In April the cost to Install a Drain Line starts at $ - $ per piping run. Use our Cost Calculator for cost estimate examples customized to the. pipe and replace it with a new pipe. The cost to replace pipe by excavating is usually calculated per foot of pipe. If the broken area of the pipe is small. One thing that's important to take into consideration is the sewer line cost per foot, which can sometimes run anywhere between $50 – $ per foot (depending. Although the cost can vary greatly depending on a number of factors, homeowners can expect to pay anywhere from $ per foot to $ per foot of pipe replaced. The average residential sewer line replacement cost is around $10, – $15, but can exceed $30, The four main things that affect your sewer line. Generally speaking, trenching is quite pricey and can cost between $4 and $12 per linear foot or up to $70 per cubic yard. This figure may seem disproportionate. Average costs for sewer replacement or sewer line repair due to broken pipe is between $3,–8,, or about $60– per linear foot. But costs can climb to. For pipes 2"-4" it costs about $ per linear foot for homes. For large commercial pipe lining jobs (over ') prices can be as low as $50 per foot. Trenchless sewer line replacement costs · Equipment and skill: $80 and $ per foot · Average cost: $ - $12, for critical sewer repairs. May go up to. Generally speaking, an average sewer replacement from a house to the public sewer usually starts around $ but, depending on the complexity, can be as high. Keep in mind that except in the simplest of scenarios, replacing sewer pipes is almost always more expensive, takes longer, and is more disruptive than.

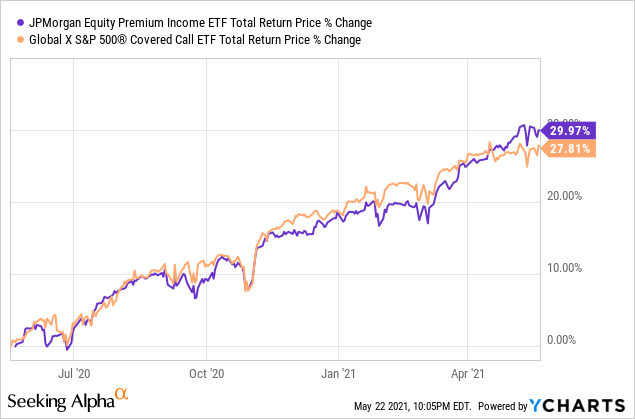

Jpmorgan Equity Income C

View Minimum Investment Information and Available Brokerage for JPMorgan Equity Income C (OINCX). JPMorgan Equity Income C (OINCX). Type. Open-end mutual fund. Manager. JPMorgan. Gender equality score. / points. Overall score. JPMorgan Equity Premium Income Fund seeks to deliver monthly distributable income and equity market exposure with less volatility. · EXPERTISE · PORTFOLIO. JPMorgan Focused Equity Income Strategy. Jump to a fund. OVERVIEW With J.P. Morgan. Strategy Facts. Asset ClassEquity. Strategy Inception Date Find the latest performance data chart, historical data and news for JPMorgan Equity Income Fd Cl C (OINCX) at filmproducers.ru Objective. The investment seeks capital appreciation and current income. Under normal circumstances, at least 80% of the fund's assets will be invested in the. The Fund invests 80% of its net assets in the equity securities of corporations that regularly pay dividends, including common stocks and debt securities and. Although the fund invests primarily in securities of large cap companies, it may invest in equity investments of companies across all market capitalizations. OINCX Portfolio - Learn more about the JPMorgan Equity Income C investment portfolio including asset allocation, stock style, stock holdings and more. View Minimum Investment Information and Available Brokerage for JPMorgan Equity Income C (OINCX). JPMorgan Equity Income C (OINCX). Type. Open-end mutual fund. Manager. JPMorgan. Gender equality score. / points. Overall score. JPMorgan Equity Premium Income Fund seeks to deliver monthly distributable income and equity market exposure with less volatility. · EXPERTISE · PORTFOLIO. JPMorgan Focused Equity Income Strategy. Jump to a fund. OVERVIEW With J.P. Morgan. Strategy Facts. Asset ClassEquity. Strategy Inception Date Find the latest performance data chart, historical data and news for JPMorgan Equity Income Fd Cl C (OINCX) at filmproducers.ru Objective. The investment seeks capital appreciation and current income. Under normal circumstances, at least 80% of the fund's assets will be invested in the. The Fund invests 80% of its net assets in the equity securities of corporations that regularly pay dividends, including common stocks and debt securities and. Although the fund invests primarily in securities of large cap companies, it may invest in equity investments of companies across all market capitalizations. OINCX Portfolio - Learn more about the JPMorgan Equity Income C investment portfolio including asset allocation, stock style, stock holdings and more.

The JPMorgan Equity Income Fund falls within Morningstar's large-value category. According to the fund's website, “The Fund's portfolio managers target high-. The funds are available only to certain qualified retirement plans and governmental plans and is not offered to the general public. Units of the funds are not. The latest fund information for JPM US Equity Income C Acc, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund. Get the latest JPMorgan Equity Income Fd Cl C (OINCX) price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Analyze the Fund JPMorgan Equity Income Fund Class C having Symbol OINCX for type mutual-funds and perform research on other mutual funds. JPMorgan Equity Income Fund C (OINCX) dividend summary: yield, payout, growth, announce date, ex-dividend date, payout date and Seeking Alpha Premium. JPMorgan Equity Income Fund. Shareclass. JPMorgan Equity Income C (OINCX). Type. Open-end mutual fund. Manager. JPMorgan. Military weapon grade: Fund is. JPMORGAN EQUITY INCOME FUND CLASS C- Performance charts including intraday, historical charts and prices and keydata. View the latest JPMorgan Equity Income Fund;C (OINCX) stock price, news, historical charts, analyst ratings and financial information from WSJ. JPMorgan Equity Income C (OINCX) is an actively managed U.S. Equity Large Value fund. JPMorgan launched the fund in The investment seeks capital. The Underlying Fund invests in equity securities of corporations that regularly pay dividends. Employs a fundamental, bottom-up stock selection process to find. Complete JPMorgan Equity Income Fund;C funds overview by Barron's. View the OINCX funds market news. JPMorgan Equity Income Fund OINCX has $ BILLION invested in fossil fuels, 15% of the fund. Tobacco Free Funds · Search. JPMorgan Equity Income Fund. Shareclass. JPMorgan Equity Income C (OINCX). Type. Open-end mutual fund. Manager. JPMorgan. Tobacco. The fund invests in dividend paying stocks of companies. It invests in stocks of companies that are deemed socially conscious in their business dealings and. The fund normally charges a front-end sales load of percent, which means out of every $10,, $9, is invested with the remaining $ going toward. Get JPMorgan Equity Income Fund Class C (OINCX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. JPMorgan Equity Income Fund Class C (11/97). OINCX. Northern Income Equity Fund (03/94). NOIEX. Using a flexible, well-diversified fixed income approach, JPMorgan Income Fund seeks to maximize income for a prudent level of risk. · Expertise · Portfolio. JPMorgan Equity Income Fund. Shareclass. JPMorgan Equity Income C (OINCX). Type. Open-end mutual fund. Manager. JPMorgan. Fossil fuel finance. Fossil fuel.