filmproducers.ru

Market

Where To Get $2 Dollar Bills

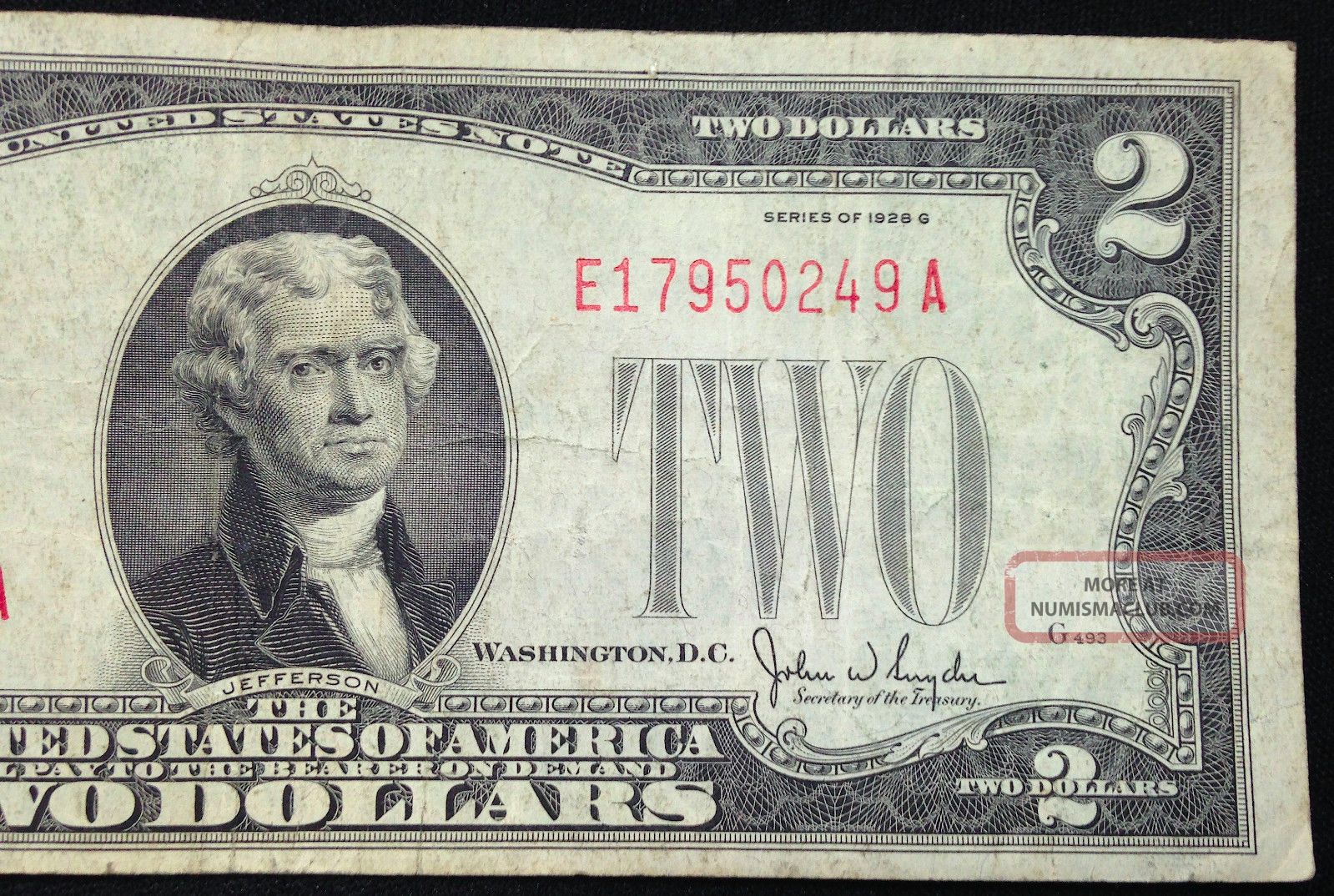

$2 notes were often returned to the Treasury with corners torn off, making them mutilated currency and unfit for reissue. •. The fortunes of the $2 note were. 08, , a.m.; | Published: Mar. 08, , a.m.. Press Photo United States currency $2 bills. Before you spend it, be aware your $2 bill. Get the best deals on $2 US Paper Money when you shop the largest online selection at filmproducers.ru Free shipping on many items | Browse your favorite brands. Make a move and get your hands on these Gold & Silver Pawn treasures - genuine United States $2 bills featuring the faces of the "Pawn Stars"! Wells Fargo always gives me $2 bills upon request. As another poster said, if your bank doesn't have them in stock, request an order. Explore the $2: Note Sheet at US Mint today. Buy numismatic products, gifts, silver and gold coins, Presidential Dollars and coin collecting supplies. Local banks should have $2 bills. If your bank does not have any current inventory, it can order $2 bills from the Federal Reserve Bank. Where can I purchase. Production continued until (), when United States Notes were phased out; the $2 denomination was discontinued until , when it was reissued as a. Explore the history, security, and design features of the $2 note. $2 notes were often returned to the Treasury with corners torn off, making them mutilated currency and unfit for reissue. •. The fortunes of the $2 note were. 08, , a.m.; | Published: Mar. 08, , a.m.. Press Photo United States currency $2 bills. Before you spend it, be aware your $2 bill. Get the best deals on $2 US Paper Money when you shop the largest online selection at filmproducers.ru Free shipping on many items | Browse your favorite brands. Make a move and get your hands on these Gold & Silver Pawn treasures - genuine United States $2 bills featuring the faces of the "Pawn Stars"! Wells Fargo always gives me $2 bills upon request. As another poster said, if your bank doesn't have them in stock, request an order. Explore the $2: Note Sheet at US Mint today. Buy numismatic products, gifts, silver and gold coins, Presidential Dollars and coin collecting supplies. Local banks should have $2 bills. If your bank does not have any current inventory, it can order $2 bills from the Federal Reserve Bank. Where can I purchase. Production continued until (), when United States Notes were phased out; the $2 denomination was discontinued until , when it was reissued as a. Explore the history, security, and design features of the $2 note.

Personalized Two Dollar Note Impress your family and friends at any special occasion, with personalized $2 Federal Reserve Notes! Celebrate any important. The United States $2 bill is a current denomination of U.S. currency. Former U.S. President Thomas Jefferson is featured on the obverse of the note. The United States $2 bill is a current denomination of U.S. currency. Former U.S. President Thomas Jefferson is featured on the obverse of the note. Where do we check to find out if our two dollar bills have any value? . 1 yr. 3. Barbara Ajah Darvine. Just used the only one I had to Wawa. The Jefferson Tribute Collection with Rare $2 Bill FREE delivery on $35 shipped by Amazon. Canada $2 Dollar Bill - Uncirculated Banknote with Random Serial # - Paper Money (Qty 1) from Tesino & Co. out of 5 stars (). $$ Australian two-dollar note · Canadian two-dollar bill · United States two-dollar bill · Disambiguation icon. This disambiguation page lists. Two Dollar Bill Complete District set - All 12 Federal Reserve Districts. Issued in August and printed by British American Bank Note Company, the $2 note features an Inuit hunting scene based on a photo taken by Doug Wilkinson at. It's a common misconception that $2 bills are particularly rare or valuable. This has led many people to hoard them and, as a result, there are large numbers of. Discover rare and authentic paper currency from the United States Mint. Explore our extensive collection of bills and notes for collectors and enthusiasts. Buy $2 Bill at PCS Stamps & Coins. What's it worth? $2 Two Dollar Bill U.S. currency price guide value list. Lookup Current Values for $2 two dollar bills. Each bill has special markings on it that can tell you which. Reserve Bank accounts for it. On $1 and $2 bills, the Reserve. Bank information is located in. 1 BLUE SILVER CERTIFICATE and RED SEAL 2 BILL Until the Series of , the 2 United States Note was issued along with other types of U.S. currency. Make a move and get your hands on these Gold & Silver Pawn treasures - genuine United States $2 bills featuring the faces of the "Pawn Stars"! Who Is on Which U.S. Dollar Bill? · $1 bill: George Washington · $2 bill: Thomas Jefferson · $5 bill: Abraham Lincoln · $10 bill: Alexander Hamilton · $20 bill. For denominations $1 and $2, the note includes a seal that identifies one of the 12 Federal Reserve banks. Excerpt of a note, showing the seal. Note Position. Get your face - or a loved one's face - on a real $2 bill with You're on the Money! Create a custom keepsake by adding your photo and name, making for a. This club is just for promoting the use of the $2 bill. It is also for photos, stories and suggestions about the same. It is not for political ads.

Earphones That Look Like Hearing Aids

A hybrid between hearing aids and Bluetooth earbuds, the Wear and Hear Personalized Headset does what no other earbuds or hearing aids do. FDA Regulated OTC Hearing Aids · Clear conversations and reduced background noise · Bluetooth playback and streaming with iOS or Android · Rechargeable battery: With a next-level hearing aid style comparable to state-of-the-art earbuds, Signia Active looks nothing like other hearing aids. Charge on-the-go. The handy. These “smart earbuds” are a cross between wireless earbuds and traditional hearing aids. Hearables can include features like noise and feedback cancellation and. Smart Bluetooth Earbuds Hearing Aids - OTC, Smart Fitting ITE Design for Mild/Moderate Hearing Loss with Noise Reduction, Charging Box Included, Green. A style to take advantage of if you use custom hearing aids is bone-conduction headphones. These hearing aid headphones transmit the sound via vibrations. Etymotic offers high definition listening, hearing, assessment, enhancement & protection with specially engineered innovative products. Best Buy customers often prefer the following products when searching for Headphones For Use With Hearing Aids. · Anker and Soundcore - Soundcore - by Anker Q20i. Yes! Hearing aids are being disguised as earbuds! Signia is one of the hearing aid brands paving the way on this front. A hybrid between hearing aids and Bluetooth earbuds, the Wear and Hear Personalized Headset does what no other earbuds or hearing aids do. FDA Regulated OTC Hearing Aids · Clear conversations and reduced background noise · Bluetooth playback and streaming with iOS or Android · Rechargeable battery: With a next-level hearing aid style comparable to state-of-the-art earbuds, Signia Active looks nothing like other hearing aids. Charge on-the-go. The handy. These “smart earbuds” are a cross between wireless earbuds and traditional hearing aids. Hearables can include features like noise and feedback cancellation and. Smart Bluetooth Earbuds Hearing Aids - OTC, Smart Fitting ITE Design for Mild/Moderate Hearing Loss with Noise Reduction, Charging Box Included, Green. A style to take advantage of if you use custom hearing aids is bone-conduction headphones. These hearing aid headphones transmit the sound via vibrations. Etymotic offers high definition listening, hearing, assessment, enhancement & protection with specially engineered innovative products. Best Buy customers often prefer the following products when searching for Headphones For Use With Hearing Aids. · Anker and Soundcore - Soundcore - by Anker Q20i. Yes! Hearing aids are being disguised as earbuds! Signia is one of the hearing aid brands paving the way on this front.

Hearing impaired headphones, are a personal sound amplifying device worn over ear, and on the ear depending on the type of headsets. sound in any environment with our Headphones collection at Hearing Aid Australia. Discover a wide range of headphones from leading suppliers like Audeara. This helps to reduce outside noise. Styles with a deep or oval cup will be more comfortable for hearing aid wearers because there is more room. This ensures the. The 1More Comfobuds mini are reputed to be the smallest earbuds made. If this is % factual I'm not sure, but every review I've seen on them. New and improved design. Knowles micro speakers. New Single ear Version, Large Carry Case, & earbuds included. Choose the one that's right for you! The new. Phonak has something called a Smartlink that is meant to be used as a microphone that goes straight to the hearing aids, but it can also be. If the hearing loss is mild or in one ear only, some people may also prefer the sound without their hearing aids. Standard headphones can be used in this. Crisp Sound turns your phone to an AI Hearing Aid. All you need is a pair of wireless earbuds or a wired headphone. If you are using wireless, bluetooth 5+. All of these workplace earphones, headsets, and ear muffs provide hearing protection for OSHA regulated workplaces in addition to music listening. Award winning IQbuds 2 MAX delivers superior high-fidelity sound with noise cancellation so you can stream your favorite music, podcasts or video. Bose QuietComfort 35 II: These over-ear Bluetooth headphones offer excellent noise-canceling capabilities and superb sound quality. They are comfortable to wear. Assistive Devices > Amplified & Bluetooth Headphones for Hard of Hearing · Williams Sound Folding Stereo Headphones HED · Wireless (Bluetooth) SleepPhones. Dr. Recommended - Wireless TV Headphones, Headsets, Hearing Aids & Listening systems. Millions sold since A Better Way to hearTV®. Our earpiece will provide a comfortable fit. No more generic eartips that aren't quite right for your ear and never seem to provide a long lasting comfortable. Is For Everyone · Hear OTC Hearing Aid Graphite | Hear OTC Hearing Aid & Earbuds. FEATURES. Hearing aids that don't look like hearing aids. · Hear. Bose Hearphones aren't your regular Bose headphones, and while they still act like regular Bluetooth headphones with really good noise cancellation, they also. Doctors of Osteopathic Medicine, or DOs, look beyond your symptoms to understand how lifestyle and environmental factors affect your wellbeing. “Hearing aids. Is For Everyone · Hear OTC Hearing Aid Graphite | Hear OTC Hearing Aid & Earbuds. FEATURES. Hearing aids that don't look like hearing aids. · Hear. The receiver-in-canal (RIC) and receiver-in-the-ear (RITE) styles are similar to a behind-the-ear hearing aid with the speaker or receiver that sits in the ear. Earphones or headphones are a pair of personal sound amplifying device designed to be held in place close to the ears of the users. They enhance the hearing.

Self Employed Small Business Tax Deductions

Self-employment tax is a % tax that is used to fund Social Security and Medicare programs. Sole proprietorships, partnerships, and limited liability. 1. Vehicle expenses · 2. Health insurance premiums · 3. Special Social Security tax · 4. Retirement tax credits and shelters · 5. Qualified business income. 1. Deducting Business Expenses. Tax Guide for Small Business · 2. Employees' Pay. Tax Guide for Small Business · 3. Rent Expense. Tax Guide for Small Business · 4. As a business owner, you may also be able to claim a tax credit amounting to 50% of the first $1, of qualified startup costs if you set up a qualified. Small-business owners, contractors, freelancers, gig workers, and others who make more than a $ profit must pay self-employment tax. Self-employed workers. Business insurance, along with other business expenses, are claimed on Schedule C. 6. Health insurance premiums. Small business owners who are self employed. Luckily, you can deduct half of these taxes on your tax return. For example, if you're a small business owner earning $,, you pay %, or $15,, in. filmproducers.ru: Tax Deductions for Businesses and Self-Employed Individuals: An A-to-Z Guide to Hundreds of Tax Write-Offs: Kamoroff. There is a tax deduction that self-employed people may be able to take advantage of called the qualified business income (QBI) deduction. The deduction for QBI. Self-employment tax is a % tax that is used to fund Social Security and Medicare programs. Sole proprietorships, partnerships, and limited liability. 1. Vehicle expenses · 2. Health insurance premiums · 3. Special Social Security tax · 4. Retirement tax credits and shelters · 5. Qualified business income. 1. Deducting Business Expenses. Tax Guide for Small Business · 2. Employees' Pay. Tax Guide for Small Business · 3. Rent Expense. Tax Guide for Small Business · 4. As a business owner, you may also be able to claim a tax credit amounting to 50% of the first $1, of qualified startup costs if you set up a qualified. Small-business owners, contractors, freelancers, gig workers, and others who make more than a $ profit must pay self-employment tax. Self-employed workers. Business insurance, along with other business expenses, are claimed on Schedule C. 6. Health insurance premiums. Small business owners who are self employed. Luckily, you can deduct half of these taxes on your tax return. For example, if you're a small business owner earning $,, you pay %, or $15,, in. filmproducers.ru: Tax Deductions for Businesses and Self-Employed Individuals: An A-to-Z Guide to Hundreds of Tax Write-Offs: Kamoroff. There is a tax deduction that self-employed people may be able to take advantage of called the qualified business income (QBI) deduction. The deduction for QBI.

Self-Employment (NEC, MISC, Schedule SE) · Payment Processing (K) · Business Profits and Losses (Schedule C) · Rental Income (Schedule E) · Home. A tax-deductible business expense is any cost incurred by an organization that can be subtracted from its taxable income, thereby reducing its tax liability. Qualified Business Income Deduction · Self-Employment Tax Deduction · Startup and Organizational Costs Tax Deductions · Travel Expenses Tax Deduction · Easily Save. You can also deduct retirement contributions. Recent changes to the tax code have made self employment (k)s much more attractive to business owners, as these. Here are 15 big self-employment tax deductions and tax benefits that could slash tax bills for freelancers, contractors & other people who. filmproducers.ru: Tax Deductions for Businesses and Self-Employed Individuals: An A-to-Z Guide to Hundreds of Tax Write-Offs: Kamoroff C.P.A. Qualified Business Income Deduction · Self-Employment Tax Deduction · Startup and Organizational Costs Tax Deductions · Travel Expenses Tax Deduction · Easily Save. If your business pays employment taxes, the employer's share is deductible as a business expense. Self-employment tax is paid by individuals, not their. You can also deduct retirement contributions. Recent changes to the tax code have made self employment (k)s much more attractive to business owners, as these. Self-employed individuals who work from home (in a workspace that is regularly and exclusively used for business purposes) are eligible to deduct the costs of. Qualified business income. · Mileage or vehicle expenses. · Retirement savings. · Insurance premiums. · Office supplies. · Home office expenses. · Credit card and. Claim the deduction on Form as an adjustment to your gross income. Self-employed health insurance deduction. The Small Business Jobs Act of created a. 14 self-employment tax deductions that could benefit your small business · 1. Retirement plan deduction · 2. Self-employment taxes deduction · 3. Home office. 11 Deductions to Avoid All Together · A small business loan—but you can deduct whatever you purchase with the loan · Business attire that you can wear outside of. The amount you can take as a tax deduction is usually half of the employer's portion. Have questions about self-employment taxes and other small business tax. 1. Self-employed health insurance deduction · 2. Business startup costs · 3. Deducting internet and other service fees · 4. Phone service tax deductions · 5. First-. Self-Employed/Deducting-Business-Expenses. Small Business Tax Deductions. FDIC OMWI Education Module: Understanding Small Business Taxes. Page Certain deductions may be taken when computing the business tax. These deductions include, but are not limited to, cash discounts, trade-in amounts, amounts. Self-Employed Health Insurance Deduction: If you made a net profit during the previous year and have a business insurance plan, you may be eligible to deduct. If you're a freelancer, contractor, or small business owner, you get tax write-offs that W-2 employees can't claim. Tell us what you do for work.

Taxation On Companies

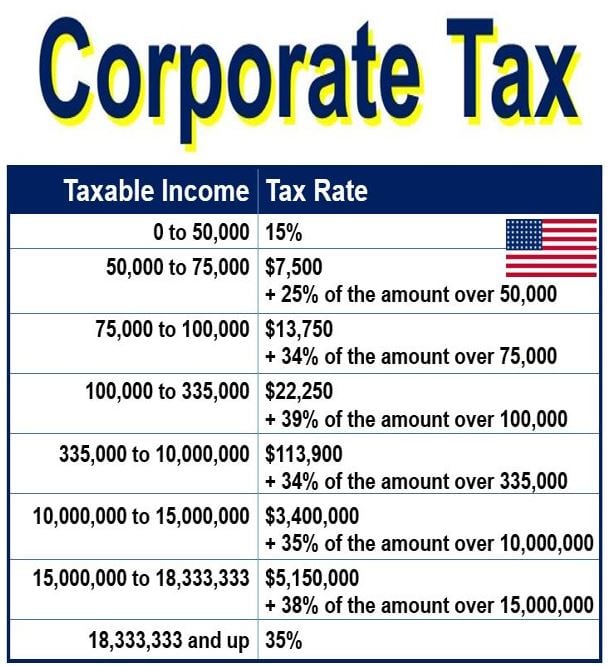

Most US businesses, including sole proprietorships, partnerships, and certain eligible corporations, do not pay federal or state corporate income taxes. Corporate Tax in India - Explore corporate tax rates and policies in India. The calculation of this tax is premised upon the net income of a company. The United States imposes a tax on the profits of US resident corporations at a rate of 21 percent (reduced from 35 percent by the Tax Cuts and Jobs Act). Domestic and foreign corporations are subject to the corporate net income tax for the privilege of doing business; carrying on activities; having capital or. The corporate income tax rates are as follows: % effective for taxable years beginning on or after % effective for taxable years beginning on. Corporate taxation aims to tax profits where value is created, but the current international tax framework was designed for the traditional economy. The profit of a corporation is taxed to the corporation when earned, and then is taxed to the shareholders when distributed as dividends. This creates a double. The Corporate Tax Rate in the United States stands at 21 percent. This page provides - United States Corporate Tax Rate - actual values, historical data. Corporate Tax Rate. Since the Tax Cuts and Jobs Act (TCJA) of , the statutory corporate income tax rate—state and federal combined—is percent. Most US businesses, including sole proprietorships, partnerships, and certain eligible corporations, do not pay federal or state corporate income taxes. Corporate Tax in India - Explore corporate tax rates and policies in India. The calculation of this tax is premised upon the net income of a company. The United States imposes a tax on the profits of US resident corporations at a rate of 21 percent (reduced from 35 percent by the Tax Cuts and Jobs Act). Domestic and foreign corporations are subject to the corporate net income tax for the privilege of doing business; carrying on activities; having capital or. The corporate income tax rates are as follows: % effective for taxable years beginning on or after % effective for taxable years beginning on. Corporate taxation aims to tax profits where value is created, but the current international tax framework was designed for the traditional economy. The profit of a corporation is taxed to the corporation when earned, and then is taxed to the shareholders when distributed as dividends. This creates a double. The Corporate Tax Rate in the United States stands at 21 percent. This page provides - United States Corporate Tax Rate - actual values, historical data. Corporate Tax Rate. Since the Tax Cuts and Jobs Act (TCJA) of , the statutory corporate income tax rate—state and federal combined—is percent.

Rhode Island Corporate Income tax is assessed at the rate of 7% of Rhode Island taxable income. To calculate the Rhode Island taxable income, the statute starts. The average for all small businesses may be %, but for sole proprietorships, it's %, for small partnerships it's %, and for small S corporations. Delaware corporate income tax returns are due in the case of a calendar year taxpayer, on or before April 15 of the following year. Michigan Corporate Income Tax (CIT). The Michigan Corporate Income Tax (CIT) was signed into law by Governor Rick Snyder on May 25, The CIT imposes a 6%. The nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of Business tax structure in Washington State. Washington State does not have a corporate or personal income tax. However, Washington businesses generally are. Business. The resources below are for businesses taxpayers looking to obtain information on filing and paying Ohio taxes, registering a business, and other. A new corporate tax applies to corporations and banks, other than federal S-corporations, that do business in New York City. Corporate income tax is based on the net worth of a corporation levied in exchange for the privilege of doing business or exercising a corporate franchise in. The tax is assessed on the taxable business profits of business organizations conducting business activity within the state. A corporate taxpayer is required to file an annual tax return (generally Form ) by the 15th day of the fourth month following the close of its tax year. A. Corporate income tax is a tax based on the income made by the corporation. The corporation begins with Federal Taxable Income from the federal tax return. The purpose of corporate tax is to generate revenue for the government by taxing the profits earned by corporations. The tax rate varies from country to country. Domestic Company means an Indian Company, or any other Company which, in respect of its income liable to tax under this Act, has made the prescribed. A corporation will automatically be subject to the state income tax of its state of incorporation, if it does business in or has income derived from that state. This explainer describes how the US corporate income tax system works, the ways it has evolved in recent years, and the implications for the United States'. (a) Corporations in general A tax is hereby imposed for each taxable year on the taxable income of every corporation. Kentucky imposes a tax on every business that is protected from liability by the laws of the state. This includes corporations, LLCs, S-Corporations, limited. Corporate Income Taxation by Scott Hodge. Corporate Income Taxation Categories: Corporations and Financial Markets Economic Regulation By Scott Hodge. Corporate income tax rates in · If the taxable amount is € , or less, the corporate income tax rate is 15%. · If the taxable amount is more than €.

Best Crowdfunding Real Estate Investment

Fundrise is a popular entry-level US platform with a low minimum investment and offerings for non-accredited investors. Investors also enjoy low fees and. CrowdStreet allows investors to directly invest in individual properties, giving them more control over their investment decisions. With a minimum investment of. Fundrise is one of the 50 largest real estate private equity investors in the world by total annual deployment — deploying more than $1 billion of capital. Over nearly a decade, Crowdestate has become Europe's leading real estate crowdfunding platform, delivering average returns of % per annum and protecting. CrowdStreet has one of the largest and most diverse selections in the business and specializes in commercial real estate (CRE) investments. One of the good. Your best options here would be to join up with your local real estate investment group (most metro areas have one or more) and network. Looking to diversify your portfolio? We rounded up the best real estate crowdfunding investment platforms of , allowing as little as $1. Land crowdfunding offers a cool method for bouncing into the market with less capital. While it enhances your ventures, make certain to explore. Looking to diversify your portfolio? We rounded up the best real estate crowdfunding investment platforms of , allowing as little as $1. Fundrise is a popular entry-level US platform with a low minimum investment and offerings for non-accredited investors. Investors also enjoy low fees and. CrowdStreet allows investors to directly invest in individual properties, giving them more control over their investment decisions. With a minimum investment of. Fundrise is one of the 50 largest real estate private equity investors in the world by total annual deployment — deploying more than $1 billion of capital. Over nearly a decade, Crowdestate has become Europe's leading real estate crowdfunding platform, delivering average returns of % per annum and protecting. CrowdStreet has one of the largest and most diverse selections in the business and specializes in commercial real estate (CRE) investments. One of the good. Your best options here would be to join up with your local real estate investment group (most metro areas have one or more) and network. Looking to diversify your portfolio? We rounded up the best real estate crowdfunding investment platforms of , allowing as little as $1. Land crowdfunding offers a cool method for bouncing into the market with less capital. While it enhances your ventures, make certain to explore. Looking to diversify your portfolio? We rounded up the best real estate crowdfunding investment platforms of , allowing as little as $1.

DiversyFund · Fees: 0% · Minimum Investment: $ · Average Annual Returns: 11% to 18%, depending on the investment · Total Investor Distributions: $ million. Best European Real Estate Crowdfunding Platforms in Europe in · EstateGuru · Reinvest24 · Kirsan Invest · Crowdpear · Indemo. Real estate crowdfunding is an investment avenue that uses crowdfunding or sourcing capital from a “crowd” of investors, to raise money for investments in real. Brikkapp is your one-stop-shop for real estate crowdfunding. Find and compare investments worldwide from as low as € Making property investment. Boasting a minimal initial investment of just $10 and modest yearly charges, Fundrise stands out as a top contender among real estate crowdfunding platforms. “Lending-based real estate crowdfunding, which involves the use of real estate to secure loans, has emerged as a promising alternative with lower risk than peer. Fundrise: Fundrise is one of the most popular and talked-about real estate crowdfunding platforms. · YieldStreet: YieldStreet is another crowdfunding platform. Crowdstreet is a leading commercial real estate investing platform. Join today to view our CRE opportunities available exclusively to accreditor investors. In equity crowdfunding, you invest in a project and receive an ownership stake. This means you share in the property's profits (or losses). First up, we've got Fundrise. This platform is a favorite among both accredited and non-accredited investors, and for good reason. They offer a wide range of. RealtyMogul is one of the top real estate crowdfunding platforms set out to make real estate investing accessible to everyone. It offers pre-vetted public. Fundrise has been around since and is the oldest and largest real estate crowdfunding platform with over , investors and over $ billion in assets. The best Real estate crowdfunding platforms · Rendity · Crowdestate · StockCrowd IN · Urbanitae · Inrento · dagobertinvest · Walliance · CITESIA. They are also ranked the best one-stop shop for real estate crowdfunding by Motley Fool. Since , RealtyMogul members have collectively invested $ Yes. The concept of pooling investor money to invest in real estate has legally existed for decades, and was called "syndication". Fundrise is the leading online real estate investment crowdfunding platform. Starting in , Fundrise was the first company to take commercial real estate. RealtyMogul simplifies commercial real estate investing. Explore select real estate opportunities. Go beyond stocks and bonds. Lendopolis is the biggest real estate crowdfunding platform focusing on renewable energy projects and has helped to fund green energy projects in the amount of. Rather than investing on a deal-by-deal basis, Fundrise has a series of eREITs and eFunds. These Real Estate Investment Trusts can be a great way to get access. RealtyMogul simplifies commercial real estate investing. Explore select real estate opportunities. Go beyond stocks and bonds.

Investment Advisor Credentials

Chartered Financial Consultant (ChFC): For general financial advice. The ChFC certification is quite similar to the CFP both in terms of covering broad. Most investment advisors hold at least a bachelor's degree in finance, economics, business administration, or a related field. Common certifications for financial planners and investment advisors include the CFP (certified financial planner), CFA (chartered financial analyst), and ChFC. investment advisers, investment adviser representatives, or general securities violations. OFFICIAL ONLINE RESOURCES. In addition to using our toll-free. The Top 3 Financial Advisor Credentials · Certified Financial Planner (CFP) · Chartered Financial Analyst (CFA) · Personal Financial Specialist (PFS) · The. The first step along the path to becoming a certified wealth manager is usually becoming a CFP® professional through the Certified Financial Planner Board of. There you can find out if your investment professional and his/her firm is licensed with the SEC, with a state(s), and/or with FINRA (the Financial Industry. Our advisors are licensed and registered · Many have additional training and certification in specialized areas · Many of our experienced financial advisors have. Type a financial professional's name in the box and you will be re-directed to the Investor Adviser Public Disclosure (IAPD) website. Chartered Financial Consultant (ChFC): For general financial advice. The ChFC certification is quite similar to the CFP both in terms of covering broad. Most investment advisors hold at least a bachelor's degree in finance, economics, business administration, or a related field. Common certifications for financial planners and investment advisors include the CFP (certified financial planner), CFA (chartered financial analyst), and ChFC. investment advisers, investment adviser representatives, or general securities violations. OFFICIAL ONLINE RESOURCES. In addition to using our toll-free. The Top 3 Financial Advisor Credentials · Certified Financial Planner (CFP) · Chartered Financial Analyst (CFA) · Personal Financial Specialist (PFS) · The. The first step along the path to becoming a certified wealth manager is usually becoming a CFP® professional through the Certified Financial Planner Board of. There you can find out if your investment professional and his/her firm is licensed with the SEC, with a state(s), and/or with FINRA (the Financial Industry. Our advisors are licensed and registered · Many have additional training and certification in specialized areas · Many of our experienced financial advisors have. Type a financial professional's name in the box and you will be re-directed to the Investor Adviser Public Disclosure (IAPD) website.

The first step along the path to becoming a certified wealth manager is usually becoming a CFP® professional through the Certified Financial Planner Board of. Consider the credentials · CFP. A certified financial planner has passed a comprehensive exam on financial planning topics, has met a threshold of performing a. The most in-demand finance advisor certification is Certified Financial Planner based on all active job postings. Having this finance advisor certification. Common Financial Credentials & Designations · CIC (Chartered Investment Counselor) · CFA (Chartered Financial Analyst) · RR (Registered. CERTIFIED FINANCIAL PLANNER® certification is the standard for financial planning. CFP® professionals meet rigorous education, training and ethical standards. Professional Designations ; Behavioral Financial Advisor, BFA, View Details ; Board Certified Fiduciary, BCF, View Details ; Board Certified in Annuities, BCA. What skills and certifications are required for financial advisors? · A finance or business degree (preferred) · Professional work experience and/or internship. The CERTIFIED FINANCIAL PLANNER™ (CFP®) professional designation is awarded to individuals who have met the requirements for education, examination, and. Examination requirement: Proof of obtaining a passing score on either 1) the Uniform Investment Adviser Law Examination (Series 65 Exam); or 2) the General. To protect their financial futures, people need the sound financial guidance you can provide by achieving the CFP® certification through CPE's seven-course. Financial planners often pursue the certified financial planner (CFP) credential. This certification requires specific education, exam, experience, and ethics. A CERTIFIED FINANCIAL PLANNER™ certification is by far the most recognized and respected financial planning designation. The marketplace knows that CFP. Investment Advisor Certification (IAC) · This course will provide participants with a comprehensive understanding of taxation principles as they relate to. The Morgan Stanley Wealth Management Financial Advisor Associate (FAA) Program is a rigorous, demanding, and intense month training and development program. Well, the CFP® = Certified Financial Planner. This is the most comprehensive planning designation. It indicates competency in all areas of financial planning. CERTIFIED FINANCIAL PLANNER (CFP) · Certified Public Accountant (CPA) · Chartered Financial Consultant (ChFC) · Chartered Life Underwriter (CLU) · Chartered. The way in which your financial planner is compensated can make all the difference in the recommendations they make for you. That's because some advisors work. Financial certification is not the same as a registration or a license. When choosing an advisor, educational achievements and professional experience are. The Morgan Stanley Wealth Management Financial Advisor Associate (FAA) Program is a rigorous, demanding, and intense month training and development program. At College for Financial Planning®—a Kaplan Company, you can pursue a professional certification, complete your CERTIFIED FINANCIAL PLANNER™ certification.

Expat Money Transfer

With low fees and competitive conversion rates, you will save thousands and move money abroad easily and securely. Transfer your money worldwide securely and at cost saving rates. Easily manage your finances while living abroad with dedicated money transfer and currency. You can make international payments and transfers from your HSBC Expat accounts on your mobile banking app to over countries and regions. Making an overseas money transfer is simple and straightforward – and, it's free with our International Moneymover Service. Our services make it easy for you to send money back home and support yourself with our most competitive exchange rates in your new country of residence. Expats regularly encounter hurdles when it comes to contracting and getting paid for their work. Differences between various financial systems, bank transfer. How to send money with Wise · Register for free. · Choose an amount to send. · Add recipient's bank details. · Verify your identity. · Pay for your transfer. Foreign exchange, or Forex, is the process of converting one currency into another. This conversion is essential for international travel, business transactions. In just 60 seconds, you can get quotes and book live money transfers. We even offer same-day transfers for all major currencies. Other currencies can be settled. With low fees and competitive conversion rates, you will save thousands and move money abroad easily and securely. Transfer your money worldwide securely and at cost saving rates. Easily manage your finances while living abroad with dedicated money transfer and currency. You can make international payments and transfers from your HSBC Expat accounts on your mobile banking app to over countries and regions. Making an overseas money transfer is simple and straightforward – and, it's free with our International Moneymover Service. Our services make it easy for you to send money back home and support yourself with our most competitive exchange rates in your new country of residence. Expats regularly encounter hurdles when it comes to contracting and getting paid for their work. Differences between various financial systems, bank transfer. How to send money with Wise · Register for free. · Choose an amount to send. · Add recipient's bank details. · Verify your identity. · Pay for your transfer. Foreign exchange, or Forex, is the process of converting one currency into another. This conversion is essential for international travel, business transactions. In just 60 seconds, you can get quotes and book live money transfers. We even offer same-day transfers for all major currencies. Other currencies can be settled.

Unrivalled customer support. You will get direct access to a dedicated money transfer specialist who will support you when you are ready to make your transfer. Foreign exchange, or Forex, is the process of converting one currency into another. This conversion is essential for international travel, business transactions. There are many dedicated online foreign exchange services. The good ones do many things better than banks when it comes to transferring money internationally. To get the best deal on international transfers, start by comparing exchange rates from various providers. Check the midmarket rate, which offers a clear. XE Money Transfer - A large international money transfer provider. Best for large sums of money since their fees are percentage-based. Send money to + countries with competitive exchange rates and low fees, all in one app. It's no wonder 45+ million worldwide customers stick with Revolut. International money transfer guide for expats · Visas and Immigration · Obtaining credit cards · Schooling · Learn the local customs · Research and prepare. Remittance inflows refer to the money that people who are working abroad send back to their home country. They are usually sent by expat workers. You need to login into Interactive Brokers and go to the left sidebar and choose Transfer & Pay -> Transfer Funds -> Make a Withdrawal. You may need to wait a. There are three main options – Banks or Building Societies, foreign exchange brokers and high street transfer firms. As a rule, Banks are a safe and convenient. Lower fees, competitive rates, and expert guidance from Mikkel Thorup make moving money abroad easy and secure. Start saving today! Save on super fast transfers worldwide. Wise is up to 3x cheaper than the banks, and free from hidden fees. Open an account. Benefits: NewbridgeFX · Multi-Currency Account In Your Company Name · Create And Manage All Your Beneficiaries · Make Fast & Secure Payments To Over Atlas Wealth Management has partnered with two of the leading expat currency foreign exchange specialists to assist clients in reducing the cost of making. Sending & receiving money from abroad: How does it work? · Open an account · Choose delivery option and amount · Add recipient's details · Pay · Finish the transfer. A money transfer involves moving funds from one bank account to another, either within the same country or internationally. For expats, this often means. However, you may have to report a gifted money transfer from overseas to the U.S., which our tax accountants can help you accomplish using IRS Form Now. XE: Best for Coverage The world's oldest online money transfer company, XE Money Transfer is widely-known in the world of currency exchange and often offers. However, banks often don't offer the best foreign exchange rates, so it can pay to research the growing number of digital international money transfer services. We've put together some of the best ways to send money abroad as an expat, and share with you our top tips on avoiding excessive fees, charges and inflated.

How Long Does Dominos Take To Deliver

Because most Domino's restaurants stay open until midnight Sunday through Thursday, and until 1 am on Friday and Saturday, you can always get pizza, pasta. Here are a few: Pizzas; Pastas; Oven Baked Sandwiches; Specialty Chicken; Bread Twists; Stuffed Cheesy Breads; Marbled Cookie Brownie. Does Domino's Deliver to. For a little background, we tell our customers 30–40 minutes for delivery. If it's an extremely large order, I give a higher estimate so we have. Order pizza, pasta, sandwiches & more online for carryout or delivery from Domino's Pizza. View menu, find locations, track orders. Great coupons and deals-order online for carry out or fast delivery of hot and delicious pizza,chicken wings & chocolate lava crunch cake from Domino's. According to a lawsuit, Domino's "30 minutes or less" guarantee has cost people their lives. In order to deliver pizzas on time, delivery drivers drove. Orders of 4 or more pizzas qualify as bulk orders, not valid for service guarantee of less than 30 minutes or free. Maximum Domino's liability is Rs. Domino's $3 20 minute delivery guarantee with online ordering At Domino's, we're all about bringing people closer, connecting them through the world's best. This process takes approximately 48 hours, but can occasionally take up to 96 hours. ▽ How do I get credit/points for past orders? To claim points for a. Because most Domino's restaurants stay open until midnight Sunday through Thursday, and until 1 am on Friday and Saturday, you can always get pizza, pasta. Here are a few: Pizzas; Pastas; Oven Baked Sandwiches; Specialty Chicken; Bread Twists; Stuffed Cheesy Breads; Marbled Cookie Brownie. Does Domino's Deliver to. For a little background, we tell our customers 30–40 minutes for delivery. If it's an extremely large order, I give a higher estimate so we have. Order pizza, pasta, sandwiches & more online for carryout or delivery from Domino's Pizza. View menu, find locations, track orders. Great coupons and deals-order online for carry out or fast delivery of hot and delicious pizza,chicken wings & chocolate lava crunch cake from Domino's. According to a lawsuit, Domino's "30 minutes or less" guarantee has cost people their lives. In order to deliver pizzas on time, delivery drivers drove. Orders of 4 or more pizzas qualify as bulk orders, not valid for service guarantee of less than 30 minutes or free. Maximum Domino's liability is Rs. Domino's $3 20 minute delivery guarantee with online ordering At Domino's, we're all about bringing people closer, connecting them through the world's best. This process takes approximately 48 hours, but can occasionally take up to 96 hours. ▽ How do I get credit/points for past orders? To claim points for a.

Order pizza, pasta, chicken & more online for carryout or delivery from your local Domino's restaurant. View our menu, find locations and track orders. Domino's offers delicious pizza, chicken & pasta, appetizers & desserts, and more! Order online for delivery or pick up. You can also call us at ! Pizza delivery is a service in which a pizzeria or pizza chain delivers a pizza to a customer. An order is typically made either by telephone, or over the. We went old school for the romance, but the ordering system was a little clunky, not knowing exactly how long the delivery was going to take. Log in to Domino's Pizza tracker to keep an eye on your order! See how soon until your pizza, pasta, dessert or side arrives at your doorstep. Tim made it very clear during our conversation that to Dominos, timing is everything. For decades they have been known as the thirty minutes or less delivery. How Long Does Domino's Take To Deliver? Domino's aim to maintain their reputation for delivering your order by the time you were quoted when it was placed. How long does it take and how will I receive my reward gift cards? Gift Do you ship international? Yes, we ship international, however the customer. Choose your meal for delivery or carryout now by ordering online. How Do I Order Food Online? It's super easy to order Domino's food online, as well as from all. Great coupons and deals-order online for carry out or fast delivery of hot and delicious pizza,chicken wings & chocolate lava crunch cake from Domino's. Order pizza, pasta, sandwiches & more online for carryout or delivery from Domino's. View menu, find locations, track orders. Sign up for Domino's email. Delivery simply adds convenience to deliciousness. When you place your Domino's delivery order, you also place your trust in the brand. Domino's stores do. Conveniently order Domino's Pizza from anywhere on your Android phone or tablet. Build your pizza just the way you like it or choose one of our specialty. According to a lawsuit, Domino's "30 minutes or less" guarantee has cost people their lives. In order to deliver pizzas on time, delivery drivers drove. Domino's Pizza, Inc., commonly referred to as Domino's, is an American multinational pizza restaurant chain founded in and led by CEO Russell Weiner. Does Domino's deliver to my area? Enter your delivery address to see if there's a Domino's on Uber Eats that offers delivery to you. Are the. Our stores are operated by world class franchisees and team members who work hard to make, bake and take our delicious food to the doors of customers. We open our doors each morning and keep them open till past midnight. Extended hours mean that almost anytime you're hungry, Domino's is ready to take your. How fast you'll get your food depends on a number of things. How far is the restaurant? How bad is traffic? Is it snowing out? The average time is approximately. Domino's Pizza | Empire Pizza. Simcoe, ON. Full-time +1. Easily apply. EmployerActive 8 days ago. An efficient driver is ready to take his order as soon as it.

How To Track A Mobile Phone Without Installing Software

What is Stalkerware? Stalkerware refers to tools - apps, software programs, and devices - that let another person secretly monitor your phone activity. Using antivirus software is the fastest and probably best way to locate spyware on an Android device. Here are the relevant steps: Ensure that you're using an. If you have an Android phone, download the 'Find My Device' app from the Google Play Store. The new Android cell phones come with the app already activated. Mobile Phone Tracker - hidden tracking app that secretly records location, SMS, call audio, WhatsApp, Facebook, Viber, camera, internet activity. SO, Can i track a cell phone location without installing software? Yes, you can! In order to track a phone with just the number, you will need to use an. Mspy is one of the most popular spy apps for Android without access to the target phone. It is a powerful monitoring tool that provides a wide range of. filmproducers.ru is the best way to track a cell phone's location. It's easy to use and can get to work in as little as 10 minutes. The most pleasant benefit is. Stalkerware refers to tools - apps, software programs, and devices - that let another person secretly monitor your phone activity. Put another cell phone in their trunk (very well hidden) sharing location with yours and connected to a big power bank. That will show you their. What is Stalkerware? Stalkerware refers to tools - apps, software programs, and devices - that let another person secretly monitor your phone activity. Using antivirus software is the fastest and probably best way to locate spyware on an Android device. Here are the relevant steps: Ensure that you're using an. If you have an Android phone, download the 'Find My Device' app from the Google Play Store. The new Android cell phones come with the app already activated. Mobile Phone Tracker - hidden tracking app that secretly records location, SMS, call audio, WhatsApp, Facebook, Viber, camera, internet activity. SO, Can i track a cell phone location without installing software? Yes, you can! In order to track a phone with just the number, you will need to use an. Mspy is one of the most popular spy apps for Android without access to the target phone. It is a powerful monitoring tool that provides a wide range of. filmproducers.ru is the best way to track a cell phone's location. It's easy to use and can get to work in as little as 10 minutes. The most pleasant benefit is. Stalkerware refers to tools - apps, software programs, and devices - that let another person secretly monitor your phone activity. Put another cell phone in their trunk (very well hidden) sharing location with yours and connected to a big power bank. That will show you their.

uMobix is a versatile spy app designed for easy and discreet monitoring of iPhone activities without needing to install software on the target. Mar 13, - Is it possible to find out how to tap a cell phone location? Learn how to track a cell phone location without installing. mSpy location tracking app is a GPS tracker that helps you locate your family, kids, friends, loved ones in real time on a live, shared, and private map. The mobile phone tracking app is often used for business purposes. Install the phone listening software on your employees' or business associates' phones. How can I track a cell phone location without installing software? If it's an iPhone, it can be tracked using the FindMy application in the. Phone GPS Tracker is a free cell phone tracker app that you can download from Google Play Store. The apps let you keep track of the phone using GPS technology. Mar 13, - Is it possible to find out how to tap a cell phone location? Learn how to track a cell phone location without installing. Discover a New Level of Location Tracking: Your Safe Connection with One Way GPS Tracker Track Any Phone iLocateMobile is your ultimate solution for secure. All you need to do is download the Mobistealth app from its official website and then get it deployed on your target's cell phone. As soon as the monitoring app. Absolutely. Tracking a cell phone is easy with Google Maps. The free-to-use service allows you to track any device logged into your Google account. If you're a. How to Track cell phones without installing software on the target phone? · Use the Phone's Built-in Features · Use Cell Phone Carrier Services. There are several ways to track a cell phone's mobile location without having to install software, so let's get right to what we feel are great solutions. I was researching it online but only found it was possible if you first got access to the phone and installed an app. Then the tracking was. This article aims to provide a comprehensive guide to help you track a cell phone location without installing any software. Spyware is a form of malicious software which can monitor your online activity without your knowledge. They may place stalkerware on your phone to track your. Thus, it's worthwhile to take the time to talk with your child about why you have installed monitoring software in the first place. After all, digital safety. FlexiSPY is monitoring software that you install on your computer or mobile device. It takes complete control of the device, letting you know everything, no. Monitoring apps are software programs that allow you to track a cell phone's location, call logs, etc remotely. Phone Tracker New! Phone Parent ® Phone Tracker provides FREE GPS, Contacts, Apps Installed and Location Activity Tracking of Phone. Spy Phone Labs.

401k Companies For Small Business

Discover the Best (k) for Small Businesses at Employee Fiduciary – Affordable, Flexible Plans Tailored to Your Needs. Get a Free Consultation Today. Search · A Small Business (k) offers assistance with your Plan's administration. · For businesses with 1 or more employees and $0-$5M in plan assets, this. Fidelity Advantage (k). An affordable plan for small businesses looking to offer a (k) for the first time. k Provider Comparison Chart ; Investment Flexibility**, No, Yes, No, No ; Google review rating, 2, 3, , Business (k) plan services to help businesses save money, maximize investments and minimize liabilities. There is a wide selection of financial service firms that offer (k) plan types that are tailored specifically to small business owners. Clear, affordable (k) pricing. Customized retirement plans start at $ per month + $5 per employee per month. Get Started. Several reputable (k) plan providers cater to small businesses. The popular options are ADP, Paychex, American Funds, Charles Schwab, Employee Fiduciary, and. What types of businesses can set up a Small Business (k)?. Corporations, partnerships and nonprofit organizations can establish Merrill Small Business (k). Discover the Best (k) for Small Businesses at Employee Fiduciary – Affordable, Flexible Plans Tailored to Your Needs. Get a Free Consultation Today. Search · A Small Business (k) offers assistance with your Plan's administration. · For businesses with 1 or more employees and $0-$5M in plan assets, this. Fidelity Advantage (k). An affordable plan for small businesses looking to offer a (k) for the first time. k Provider Comparison Chart ; Investment Flexibility**, No, Yes, No, No ; Google review rating, 2, 3, , Business (k) plan services to help businesses save money, maximize investments and minimize liabilities. There is a wide selection of financial service firms that offer (k) plan types that are tailored specifically to small business owners. Clear, affordable (k) pricing. Customized retirement plans start at $ per month + $5 per employee per month. Get Started. Several reputable (k) plan providers cater to small businesses. The popular options are ADP, Paychex, American Funds, Charles Schwab, Employee Fiduciary, and. What types of businesses can set up a Small Business (k)?. Corporations, partnerships and nonprofit organizations can establish Merrill Small Business (k).

Here are a few financial service companies that are leading the pack by only providing great, affordable retirement plans, but also leading in customer service. There are many reasons you'll want to consider starting a (k) plan and benefits of doing so for both the business and the employees. Unlock the future of retirement planning with Ubiquity's customized, low-cost (k) solutions for small businesses and self-employed individuals. Morgan Stanley at Work offers small business (k) services to help you and your employees reach their retirement plan goals. Furthermore, working with a. Looking for a retirement plan or business investing account? Schwab offers a range of small business solutions to help you manage your finances. Employee Fiduciary, founded in , is a (k) plan provider for small businesses. Employee Fiduciary provides retirement plan recordkeeping and. Some (k) plan providers cater to smaller companies, such as a startup or those with fewer than 50 employees, while others are set up for medium-sized or. GO is the premier provider of fast and affordable (k) plans optimized for small and medium sized businesses dedicated to reaching their full. Information on retirement plans for small businesses and the self-employed. Choose a Plan, Maintain a Plan, Find or Fix Plan Errors, Plan Benefits. Explore your options and find a tax-advantaged small business plan as a self-employed professional, entrepreneur, or business owner. Discover the Best (k) for Small Businesses at Employee Fiduciary – Affordable, Flexible Plans Tailored to Your Needs. Get a Free Consultation Today. A solo (k) is intended for sole proprietors and other small businesses who have no employees other than a spouse. Through a combination of elective salary. The solo (k) is a retirement savings option for small businesses whose only eligible participants in the plan are the business owners. Meet Simply Retirement by Principal. Learn more this low cost (k) plan for all small business owners and create a proposal today. ▫ Allows participants to take their benefits with them when they leave the company, easing administrative responsibilities. This publication provides an. Search · A Small Business (k) offers assistance with your Plan's administration. · For businesses with 1 or more employees and $0-$5M in plan assets, this. A Small Business (k) is a streamlined and affordable retirement plan designed with small business owners and their employees in mind. With a (k) plan, employees can typically make larger salary deferrals than with other retirement plans, and your business gets tax benefits. What do I get. Three retirement plan options stand-out for small businesses depending on the flexibility you need and what you want to accomplish with your benefits.