filmproducers.ru

Learn

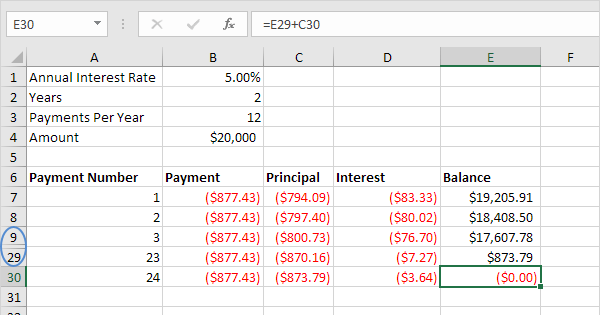

Promissory Note Amortization Schedule

Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Loan Calculator: Estimate Your Repayment. Quickly calculate a loan payment and see a payoff schedule. Loan details. Loan amount. Interest rate. Loan term . This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. While you are unable to calculate the repayment period on the schedule, the finance representative helps you in easily calculating it. In this deferred payment meaning, the lender will extend the loan term by the deferment period to keep the amortization term unchanged. Therefore, the only. This online tool will help you create a customized amortization schedule for your loan with this online calculator promissory note associated with a. Our loan calculator will help you generate monthly and yearly amortiztion schedules for any proposed loan. Find your monthly payment, total interest and. The monthly payments you make are calculated with the assumption that you will be paying your loan off over a fixed period. A longer or shorter payment schedule. An unsecured promissory note with amortized payments is a promise to pay back a loan when there's no collateral, and it'll be repaid in equal installments. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Loan Calculator: Estimate Your Repayment. Quickly calculate a loan payment and see a payoff schedule. Loan details. Loan amount. Interest rate. Loan term . This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. While you are unable to calculate the repayment period on the schedule, the finance representative helps you in easily calculating it. In this deferred payment meaning, the lender will extend the loan term by the deferment period to keep the amortization term unchanged. Therefore, the only. This online tool will help you create a customized amortization schedule for your loan with this online calculator promissory note associated with a. Our loan calculator will help you generate monthly and yearly amortiztion schedules for any proposed loan. Find your monthly payment, total interest and. The monthly payments you make are calculated with the assumption that you will be paying your loan off over a fixed period. A longer or shorter payment schedule. An unsecured promissory note with amortized payments is a promise to pay back a loan when there's no collateral, and it'll be repaid in equal installments.

How to Calculate Loan Amortization You'll need to divide your annual interest rate by For example, if your annual interest rate is 3%, then your monthly. An amortization schedule is the loan report showing the amount paid each period and the portion allocated to principal and interest. Promissory Installment Note, includes Loan Amortization Schedule Calculator (MS Excel) No Ads, No Affiliates, No Subscription Plans, No Hidden Fees, No Sharing. Payments at Maturity. A final payment equal to all unpaid principal and accrued interest is due on the last scheduled payment date on the amortization schedule. Amortization schedules use columns and rows to illustrate payment requirements over the entire life of a loan. Looking at the table allows borrowers to see. Actual figures provided on Promissory Note. See a Community Bank representative for more details. Home. We're a full-service financial institution, offering. Simply put, an amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. Amortization. We can intuitively think of this as a year of paying interest with no principal repayment required and then a four-year loan with principal payment required. An amortization schedule is a list of payments for a mortgage or loan, which shows how each payment is applied to both the principal amount and the interest. This spreadsheet creates an amortization schedule for a fixed-rate loan, with optional extra payments. The payment frequency can be annual, semi-annual. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual. Annual interest rate for this loan. Interest is calculated monthly on the current outstanding balance of your loan at 1/12 of the annual rate. Choose installment loan a that is fully amortized over the term. This option will always have a term that is equal to the amortization term. Choose balloon to. 1. Create column A labels · 2. Enter loan information in column B · 3. Calculate payments in cell B4 · 4. Create column headers inside row seven · 5. Fill in the ". Loan schedule. A, B, C, D, E, F, G, H, I, J, K, L. 1. 2, Loan amortization schedule. 3. 4, Enter values, Loan summary. 5, Loan amount, $5,, Scheduled. Loan Amortization. Sheet1. A, B, C, D, E, F, G, H, I, J, K, L, M, N, O, P, Q, R, S, T, U, V, W, X, Y, Z, AA. 1. To use this document, go to the File menu and ". Principal Amortization. During the initial Term, the Loan shall be an interest-only loan and Borrower shall not be required to make any regularly scheduled. Use this amortization schedule calculator to create a printable table for a loan or mortgage with fixed principal payments. The monthly payments are not fully amortized, which means the short term does not cover the entire loan repayment. Borrowers usually make monthly interest-only.

Best Junior Gold Miners

The best set up for gold stocks. I am personally irresponsibly long on Junior gold miner with assets in Latam and listed in Toronto. ETF List: 15 ETFs ; JNUG, Direxion Daily Junior Gold Miners Index Bull 2X Shares, Direxion ; SGDM, Sprott Gold Miners ETF, Sprott, Inc. ; SGDJ, Sprott Junior Gold. GDXJ - Overview, Holdings & Performance. The ETF offers one-traded access to junior gold miners. Endeavour Mining Plc, %, Non Energy Minerals ; B2gold Corp, %, Non Energy Minerals ; Hecla Mining Co. %, Non Energy Minerals ; Industrias Penoles. GDXJ ETF VanEck Junior Gold Miners ETF. The GDXJ Exchange Traded Fund (ETF) is provided by VanEck. It is built to track an index. Torex is a junior gold mining company that owns the Morelos gold property in Mexico. · Dundee is another Canada-listed gold mining junior. · K92 is a Vancouver-. Compare the performance, fees, and features of the most popular Gold Miners ETFs to find the one that best meets your investment goals. ETF investors have three choices of junior mining funds: the VanEck Vectors Junior Gold Miners ETF (NYSE: GDXJ), the Sprott Junior Gold Miners ETF (NYSE: SGDJ). The best resources for researching and learning about gold mining and silver mining amongst other metal miners is to read The Northern Miner publication. The best set up for gold stocks. I am personally irresponsibly long on Junior gold miner with assets in Latam and listed in Toronto. ETF List: 15 ETFs ; JNUG, Direxion Daily Junior Gold Miners Index Bull 2X Shares, Direxion ; SGDM, Sprott Gold Miners ETF, Sprott, Inc. ; SGDJ, Sprott Junior Gold. GDXJ - Overview, Holdings & Performance. The ETF offers one-traded access to junior gold miners. Endeavour Mining Plc, %, Non Energy Minerals ; B2gold Corp, %, Non Energy Minerals ; Hecla Mining Co. %, Non Energy Minerals ; Industrias Penoles. GDXJ ETF VanEck Junior Gold Miners ETF. The GDXJ Exchange Traded Fund (ETF) is provided by VanEck. It is built to track an index. Torex is a junior gold mining company that owns the Morelos gold property in Mexico. · Dundee is another Canada-listed gold mining junior. · K92 is a Vancouver-. Compare the performance, fees, and features of the most popular Gold Miners ETFs to find the one that best meets your investment goals. ETF investors have three choices of junior mining funds: the VanEck Vectors Junior Gold Miners ETF (NYSE: GDXJ), the Sprott Junior Gold Miners ETF (NYSE: SGDJ). The best resources for researching and learning about gold mining and silver mining amongst other metal miners is to read The Northern Miner publication.

The Fund seeks to replicate as closely as possible the price and yield of the Market Vectors Junior Gold Miners Index. In the. s, precious metals and commodities were the best-performing asset classes, with gold rallying from a low of $ in to $1, an ounce by Rick Rule Reveals the Best High-Growth Gold Producer to Buy (plus junior mining stock tips). Posted on August 25th, Expert Mining Investment Sector. Get the latest VanEck Junior Gold Miners ETF (GDXJ) fund price, news, buy or sell recommendation, and investing advice from Wall Street professionals. #1. Sprott Gold Miners ETF SGDM · #2. Sprott Junior Gold Miners ETF SGDJ · #3. iShares MSCI Global Gold Miners ETF RING · #4. iShares MSCI Global Silver&Mtls Mnrs. Top 10 Holdings ; Alamos Gold, Inc. % ; Pan American Silver Corp. % ; Harmony Gold Mining. % ; Compañía de Minas Buenaventura SAA. % ; Evolution. A junior mining company is one that generates a small or no revenue from the production of gold. The focus for them is exploring and trying to find deposits of. Index Top Ten Holdings ; Kinross Gold. % ; Alamos Gold. % ; Harmony Gold Mining. % ; Pan American. %. BTU Metals Corp. is a Canadian based exploration company focused on their Dixie Halo project in the Red Lake mining district. The Dixie Halo gold project totals. Great Panther Mining Limited is a Canadian-based precious metals mining and exploration company with three mines in Mexico and exploration projects in Mexico. Our explanations are a great way to expand your investment knowledge, and they're a work of passion for us. But you can supplement that knowledge and grow even. The TSXV is your best source for junior miners. This stock exchange has mining companies conveniently broken down into categories. Just like any other. TSX Venture, + (%), ; ASX , + (%), 8, ; S&P , + (%), 5, ; BMO Junior Gold Index, + (%), ; VanEck Jr. Junior Stock Review helps you find the best financial products for your investment style & budget. We cover the latest news on mining stocks. Top 10 Holdings ; Endeavour Mining PLC, EDVMF, % ; Industrias Penoles S.A.B. de C.V., IPOAF, % ; B2Gold Corp. BTG, % ; Hecla Mining Co. HL, %. Good gold prices are delighting several miners, said David Erfle, founder and editor of the filmproducers.ru On Thursday Erfle recorded Digging Deep with. Mining company stocks. Small cap mining stocks. Gold mining stocks. Best mining stocks VanEck Vectors Gold Miners ETF (GDX) and Junior Gold Miners ETF (GDXJ). best global places to invest in junior gold mining companies · Investing In Battery Metals · top three 3 silver stocks to buy for · Top three gold stocks. Alamos Gold, %, $,, ; Yamana Gold, %, $,, ; Real Gold Mining Ltd, %, $,, ; Harmony Gold Mining Co Ltd, %, $,,

Sell Car Under Loan

You can't legally sell a car that still has an unpaid loan. The financing party has an ownership interest in the car - a lien - that is not. Note: If you're selling a car with an active loan, you're still the one responsible for paying it off, so the remaining balance on the loan will likely be. Settle the Loan Before Selling: One strategy to “Can you sell your car back to the dealership” is first paying off the loan. · Dealer Pays Off the Loan · Trade-In. Can I sell my car to Carvana even if I still have a loan on my vehicle? Yes. To begin, you'll provide your loan payoff information, and in some cases, we can. Should I continue to make payments on my loan once I begin the process of selling my car? Yes. To avoid any late payment penalties, please continue to make. We will pay off the loan and deduct this amount from the money you are paid for selling your car. If your vehicle is worth more than the pay-off amount, we will. You typically must clear the outstanding loan balance before transferring ownership when selling a financed car. This benefits you because you'. Step One: Know What Your Car Is Worth · Step Two: Learn Your Payoff Amount · Step Three: Determine Your Equity · Step Four: Sell to a Private Party or Dealer · Step. But trading in a car with negative equity is very simple for a dealership, within reason. The amount you're upside-down can be tacked onto the loan for the car. You can't legally sell a car that still has an unpaid loan. The financing party has an ownership interest in the car - a lien - that is not. Note: If you're selling a car with an active loan, you're still the one responsible for paying it off, so the remaining balance on the loan will likely be. Settle the Loan Before Selling: One strategy to “Can you sell your car back to the dealership” is first paying off the loan. · Dealer Pays Off the Loan · Trade-In. Can I sell my car to Carvana even if I still have a loan on my vehicle? Yes. To begin, you'll provide your loan payoff information, and in some cases, we can. Should I continue to make payments on my loan once I begin the process of selling my car? Yes. To avoid any late payment penalties, please continue to make. We will pay off the loan and deduct this amount from the money you are paid for selling your car. If your vehicle is worth more than the pay-off amount, we will. You typically must clear the outstanding loan balance before transferring ownership when selling a financed car. This benefits you because you'. Step One: Know What Your Car Is Worth · Step Two: Learn Your Payoff Amount · Step Three: Determine Your Equity · Step Four: Sell to a Private Party or Dealer · Step. But trading in a car with negative equity is very simple for a dealership, within reason. The amount you're upside-down can be tacked onto the loan for the car.

It's the buyer's responsibility to repay the debt but, because the car forms the basis of the secured loan, the outstanding balance will always apply against. Can you trade in a financed car? Absolutely! How does trading in a financed car work? Find out now with the Mercedes-Benz of Los Angeles finance center! You can hold off on the trade-in until you've saved up enough money to pay off the loan or pay extra on the loan until you're no longer upside down. This is. You can also sell the car and then take out another loan to cover the remaining amount owed. Can You Trade In an Upside Down Car? Some dealerships allow you to. In almost all cases, you can sell your car that still has a loan on it. If you have positive equity in the car, you will get a check for the balance! Yes, you can sell a car on finance, but technically the car does not belong to you as it is under a finance contract with a lender like a bank or car. In almost all cases, you can sell your car that still has a loan on it. If you have positive equity in the car, you will get a check for the balance! Key Takeaways · Yes, you can sell a car that you financed, even if you still owe money on it. · You'll need to determine your payoff amount, pay off the car loan. Why apply for a Private Sale Vehicle Loan? · Borrow up to the full purchase price. Money available to buy the new or used vehicle of your choice. · Competitive. Beyond these risks, the truth is that if you still owe money on your car, it's probably not in your financial interest to sell it right now anyway, especially. The Title: This is the most important paperwork needed to sell your car. People that still have a lien will need to tell the holder about the sale. You must pay. Can you trade in a financed car? In most instances, yes, you can trade in a car with a loan, and some dealers might roll your remaining balance into a new loan. Dealer Pays Off the Loan: In some cases, the dealership might agree to pay off the remaining loan balance as part of the purchase. This can be an efficient way. You can also sell the car and then take out another loan to cover the remaining amount owed. Can You Trade In an Upside Down Car? Some dealerships allow you to. You can't trade in your vehicle if there is a lien on your title. You will need a statement from the lienholder stating that the loan has been paid in full. Can I sell my car to Carvana even if I still have a loan on my vehicle? Yes. To begin, you'll provide your loan payoff information, and in some cases, we can. Selling a Car with a Loan in Missouri · 1. Contacting Your Lender to Determine the Payoff Amount · 2. Evaluating Your Car's Value · 3. Transferring Ownership and. Auto Lenders will buy almost any vehicle. If the car doesn't meet our requirements, we'll happily refer you to a company that can help in your selling process. So if you're trading in the car at a dealer, in order to legally own the vehicle the dealer needs to pay off the loan from the amount they are. Option #2: Sell the vehicle · Option #3: Trade-in your car at a dealership · Option #4: Refinance for a lower interest rate and payment.

Stocks Under 50 Cents Nasdaq

A penny stock is a share that trades for $5 or less. While some investors consider penny stocks as trading for amateurs, Wall Street analysts and other. $50 for every one share you own, leaving you with 20 shares. Or, in a 3-for So, if you owned 5, shares of stock at a price of 10 cents per share. Most Active Penny Stocks · LUNRLUNRW · Intuitive Machines lands $M NASA contract · FCUV · Focus Universal Founder Acquires % More Stock · LESL · LESL. Learn about the risks of penny stocks and speculative stock investments and how this market works. Best Penny Stocks Under 50 Cents Right Now ; #1 - FuelCell Energy. NASDAQ:FCEL · $ (+$) ; #2 - Charge Enterprises. NASDAQ:CRGE · $ (-$) ; #3 - Maxeon. 0. –. BNOX. BIONOMICS LIMITED. 48 We've collected a NYSE and NASDAQ list of penny stocks under $1 and sorted. Penny stocks — US stocks ; LUXH · D · USD, −% ; KXIN · D · USD, −% ; AKTS · D · USD, +% ; BNZI · D · USD, −%. Penny Stocks Under 50 Cents is a list of OTC stock gainers and losers with volume greater or equal to You can adjust the volume, gainers and losers. This page provides a list of penny stocks (those trading between and ) sorted by the highest 5-day percent change. These high-volatility stocks. A penny stock is a share that trades for $5 or less. While some investors consider penny stocks as trading for amateurs, Wall Street analysts and other. $50 for every one share you own, leaving you with 20 shares. Or, in a 3-for So, if you owned 5, shares of stock at a price of 10 cents per share. Most Active Penny Stocks · LUNRLUNRW · Intuitive Machines lands $M NASA contract · FCUV · Focus Universal Founder Acquires % More Stock · LESL · LESL. Learn about the risks of penny stocks and speculative stock investments and how this market works. Best Penny Stocks Under 50 Cents Right Now ; #1 - FuelCell Energy. NASDAQ:FCEL · $ (+$) ; #2 - Charge Enterprises. NASDAQ:CRGE · $ (-$) ; #3 - Maxeon. 0. –. BNOX. BIONOMICS LIMITED. 48 We've collected a NYSE and NASDAQ list of penny stocks under $1 and sorted. Penny stocks — US stocks ; LUXH · D · USD, −% ; KXIN · D · USD, −% ; AKTS · D · USD, +% ; BNZI · D · USD, −%. Penny Stocks Under 50 Cents is a list of OTC stock gainers and losers with volume greater or equal to You can adjust the volume, gainers and losers. This page provides a list of penny stocks (those trading between and ) sorted by the highest 5-day percent change. These high-volatility stocks.

The Best Stocks Under $1 at a Glance ; NASDAQ: OGI. $ $m. 1,, ; CVE: INX. $ $11,4m. 5, %, 50K, Buy/Sell · PSNY · Polestar If you're buying your first penny stocks, begin by searching for stocks on major exchanges, like the NYSE or NASDAQ. Our growth stock expert, Brian Bolan, will be targeting truly exceptional low-priced stocks that offer. CENT | Complete Central Garden & Pet Co. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Stocks under 50 cents: Daily Price Predictions of Stocks with Smart Technical Market Analysis. Derived from the 50 most active stocks priced under $5 listed on the NSD exchange. The default setting shows stocks ranging from $ to $ Penny stocks are low-priced shares with small market capitalization. In India, these stocks are typically priced below ₹ Due to their illiquidity, limited. Quick Look at the Best Penny Stocks Under 10 Cents: Medical Marijuana Inc; Caduceus Software Systems; Virtual Medical International, Inc. Fiore Cannabis Ltd. Brokers are often paid "under the table" undisclosed payoffs to sell such stocks. Dump and dilute schemes, where companies repeatedly issue shares for. NASDAQ ; Brenmiller Energy Ltd. BNRG. %. ,, ; Focus Universal Inc. FCUV. %. ,, ; Leslie''s Inc. LESL. %. 11,, ; MicroCloud. Elite Pharmaceuticals, Inc. [OTCQB: ELTP] · AgriFORCE Growing Systems Ltd. [NASDAQ: AGRI] · SciSparc Ltd. [NASDAQ: SPRC] · KULR Technology Group Inc. [AMEX: KULR]. Penny stocks are public companies that have a current share price of $ or less. These companies are listed on major stock exchanges and have market. NASDAQ: PEGY — Pineapple Energy Inc — The Energy Penny Stock With the Crappy Catalyst; NASDAQ: PRZO — Parazero Technologies Ltd — My 40% Birthday Drone Safety. Todays Top Performing Penny Stocks ; VOXX International Corp (VOXX) · $ ; Oragenics Inc (OGEN) · $ ; One Stop Systems, Inc (OSS) · $ ; GCT Semiconductor. But it can also be an emotionally and financially rewarding experience for successful penny stock investors. Are penny stocks a good investment? Most penny. The Securities Division considers a stock to be a “penny stock” if it trades at or under $ per share and trades in either the “pink sheets” or on NASDAQ. Stocks Under $10 · SmartKem Inc SMTK. Price: $5. Daily change: N/A · Outlook Therapeutics Inc OTLK. Price: $ Daily change: N/A · Vaccinex Inc VCNX. Price. Compare to diagnosis success rates after a waiting period, ~50% for September Penny Stock Catalysts Calendar for Biotech/Pharma along with few DDs. A penny stock refers to a small company's stock that typically trades for less than $5 per share. · Although some penny stocks trade on large exchanges such as. A penny stock is a unit of common stock that trades with a low share price: below £1 in the UK and below $5 in the US. They're also referred to as penny.

Federal Reserve Raise Rates

In fact, interest on reserve balances is the primary tool the Fed uses to adjust the federal funds rate. Overnight Reverse Repurchase Agreement Facility: The. This is a list of historical rate actions by the United States Federal Open Market Committee (FOMC). The FOMC controls the supply of credit to banks and the. More specifically, the Federal Reserve decreases liquidity by selling government bonds, thereby raising the federal funds rate because banks have. When the Fed cuts interest rates they are lowering the fed funds target rate. This is the rate banks charge each other when lending money overnight. Before the global financial crisis, the Federal Reserve used OMOs to adjust the supply of reserve balances so as to keep the federal funds rate--the interest. The increase in demand for funds in the federal funds market will pull the federal funds rate higher. These transactions will continue until any significant gap. Markets have anticipated such Fed action for months, but rate cut speculation increased after a disappointing July labor market report showing rising. The Fed lowers interest rates in order to stimulate economic growth, as lower financing costs can encourage borrowing and investing. However, when rates are too. Bottom line. The Federal Reserve has increased the Federal Funds rate once again. This move is likely to continue pushing interest rates higher for mortgages. In fact, interest on reserve balances is the primary tool the Fed uses to adjust the federal funds rate. Overnight Reverse Repurchase Agreement Facility: The. This is a list of historical rate actions by the United States Federal Open Market Committee (FOMC). The FOMC controls the supply of credit to banks and the. More specifically, the Federal Reserve decreases liquidity by selling government bonds, thereby raising the federal funds rate because banks have. When the Fed cuts interest rates they are lowering the fed funds target rate. This is the rate banks charge each other when lending money overnight. Before the global financial crisis, the Federal Reserve used OMOs to adjust the supply of reserve balances so as to keep the federal funds rate--the interest. The increase in demand for funds in the federal funds market will pull the federal funds rate higher. These transactions will continue until any significant gap. Markets have anticipated such Fed action for months, but rate cut speculation increased after a disappointing July labor market report showing rising. The Fed lowers interest rates in order to stimulate economic growth, as lower financing costs can encourage borrowing and investing. However, when rates are too. Bottom line. The Federal Reserve has increased the Federal Funds rate once again. This move is likely to continue pushing interest rates higher for mortgages.

Selected Interest Rates · 1-year, , , , · 2-year, , , , · 3-year.

Lowering rates stimulates the economy; raising rates slows the economy down. The agency doesn't actually set the funds rate — banks do that — but "the Fed. The Fed raised rates after the COVID pandemic and Russian invasion of Ukraine together spurred alarming inflation, but calls are mounting to lower them amid. The interest rate we control is the cash rate, which is the rate that banks charge each other to borrow overnight. Now this interest rate influences other. Typically, the Federal Reserve meets around six times a year to discuss the federal funds rate. They may decide to decrease or increase it based off the. We continue to expect the Fed to cut the federal funds rate by % to a target range of % to %, most likely in September, with one or two more likely. Interest rates on personal loans have risen from % at the beginning of the Fed rate hikes in to % in May , according to the latest data. The Market Probability Tracker estimates probability distributions implied by the prices of options from the Chicago Mercantile Exchange. Effective Federal Funds Rate ; 08/20, , , , ; 08/19, , , , Use CME FedWatch to track the probabilities of changes to the Fed rate, as implied by Day Fed Funds futures prices. The Fed meets eight times each year to discuss whether to keep the federal funds rate steady or adjust it. The committee increased its benchmark rate 11 times. Interest Rate in the United States averaged percent from until , reaching an all time high of percent in March of and a record low of. These cuts lowered the funds rate to a range of 0% to %. The federal funds rate is a benchmark for other short-term rates, and also affects longer-term. When is the next Fed rate hike? The Federal Reserve's next meeting is scheduled for September 17 and The Fed is likely done raising interest rates at this. All that would appear to be in doubt is the size of the cut. As of September 5, interest rate traders assigned a 59% probability to the FOMC slicing the short-. When inflation is too high, the Federal Reserve typically raises interest rates to slow the economy and bring inflation down. When inflation is too low, the. Federal Open Market Committee (FOMC) members vote on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the. As the financial crisis and the economic contraction intensified in the fall of , the FOMC accelerated its interest rate cuts, taking the rate to its. The official Twitter channel of the Board of Governors of the Federal Reserve System. Privacy Policy: filmproducers.ru The Fed lowers interest rates in order to stimulate economic growth, as lower financing costs can encourage borrowing and investing. However, when rates are too. The next FOMC meeting will be held in September The Fed has held rates steady at %% already for several months, which has provided some relief.

Gold Price In Us Dollars Per Ounce

Live Gold Price ; GOLD USD/Oz, , , , ; GOLD EUR/Oz, , , , Assuming the investor bought gold at approximately $/ounce ($/gram) in January , the average cost per ounce of gold would be $ ($/gram). Gold spot prices are universal, as most gold markets use live gold prices listed in U.S. dollars, so the price of gold per ounce is the same worldwide. Shop. Gold Price per Ounce in the United States Now, the gold price per ounce in the U.S.A is $2, USD. For a deeper analysis, including performance metrics. Gold / US Dollar Spot XAU=:Exchange · Open2, · Prev Close2, · Day High · Day Low What is the price of one gram of gold today? · Today, the spot price for a gold ounce is € and $ · The price for an ounce of GoldPremium is €. Live Gold Charts and Gold Spot Price from International Gold Markets USA Dollar USD. + (+%). Ask. 2, ounce. 2, + gram. gold price per troy ounce in U.S. dollars (USD). One can, however, get the price of gold per gram or kilo, as well. What does the "gold spot price" mean? filmproducers.ru - The number 1 web site for United States spot gold price charts in ounces, grams and kilos. Live Gold Price ; GOLD USD/Oz, , , , ; GOLD EUR/Oz, , , , Assuming the investor bought gold at approximately $/ounce ($/gram) in January , the average cost per ounce of gold would be $ ($/gram). Gold spot prices are universal, as most gold markets use live gold prices listed in U.S. dollars, so the price of gold per ounce is the same worldwide. Shop. Gold Price per Ounce in the United States Now, the gold price per ounce in the U.S.A is $2, USD. For a deeper analysis, including performance metrics. Gold / US Dollar Spot XAU=:Exchange · Open2, · Prev Close2, · Day High · Day Low What is the price of one gram of gold today? · Today, the spot price for a gold ounce is € and $ · The price for an ounce of GoldPremium is €. Live Gold Charts and Gold Spot Price from International Gold Markets USA Dollar USD. + (+%). Ask. 2, ounce. 2, + gram. gold price per troy ounce in U.S. dollars (USD). One can, however, get the price of gold per gram or kilo, as well. What does the "gold spot price" mean? filmproducers.ru - The number 1 web site for United States spot gold price charts in ounces, grams and kilos.

Gold Price in USD per Troy Ounce for Last 10 Years. Gold Price (Ounce), $2,%, Unavailable. filmproducers.ru - The No. 1 gold price site for. Gold price per gram, , ; Gold price per kilogram, 80,, ; Gold price in tola, , ; Gold price in tael (HK), 3,, Live Gold Spot Prices ; Gold Prices Per Ounce, $2, + ; Gold Prices Per Gram, $ + ; Gold Prices Per Kilo, $80, + Today's gold price in United States is $ USD per ounce. Get detailed information, charts, and updates on gold rates in major cities of United States. Today's Gold Price in US = USD / 1 Gram*. Gold Price · Silver Price. Amount of Gold in Gram. Gold Price in USD per Troy Ounce for Last 6 Months. The price of gold today, as of am ET, was $2, per ounce. That's up % from yesterday's gold price of $2, Compared to last week, the price of. Convert Gold Ounce to US Dollar ; 1 XAU. 2, USD ; 5 XAU. 12, USD ; 10 XAU. 25, USD ; 25 XAU. 62, USD ; 50 XAU. , USD. Gold Price Performance USD ; 1/10 oz Gold Eagle. Official US Gold Bullion Coin; Highly Liquid and Easily Recognizable; $5 Face Value. As Low As. $ Shop. Gold prices today ; US Dollar (USD), , $2,, $80,, $ ; British Pound (GBP), , £1,, £61,, £ Today's Gold Price in USD per Ounce ; 2,, 2,, 2, Typically, however, spot gold is quoted in price per ounce using U.S. Dollars. Quotes are also available depicting the spot gold price in other currencies as. Live Gold Prices | Price of Gold Per Ounce ; Live Gold Price per Ounce, $2,, $ ; Live Gold Price per Gram, $, $ ; Live Gold Price per Kilo. Gold Price in US Dollars is at a current level of , up from the previous market day and up from one year ago. This is a change of %. See live Gold Spot Price Charts & historical data. Price of Gold per ounce today. Learn about the Gold Price at SD Bullion gold price in US dollars as well. Gold is expected to trade at USD/t oz. by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Looking. filmproducers.ru - The No. 1 gold price site for fast loading live gold price charts in ounces, grams and kilos in every national currency in the world. Money Metals Live Gold Spot Prices ; Gold Price per Ounce, $2, ; Gold Price per Gram, $ ; Gold price per kilo, $81,

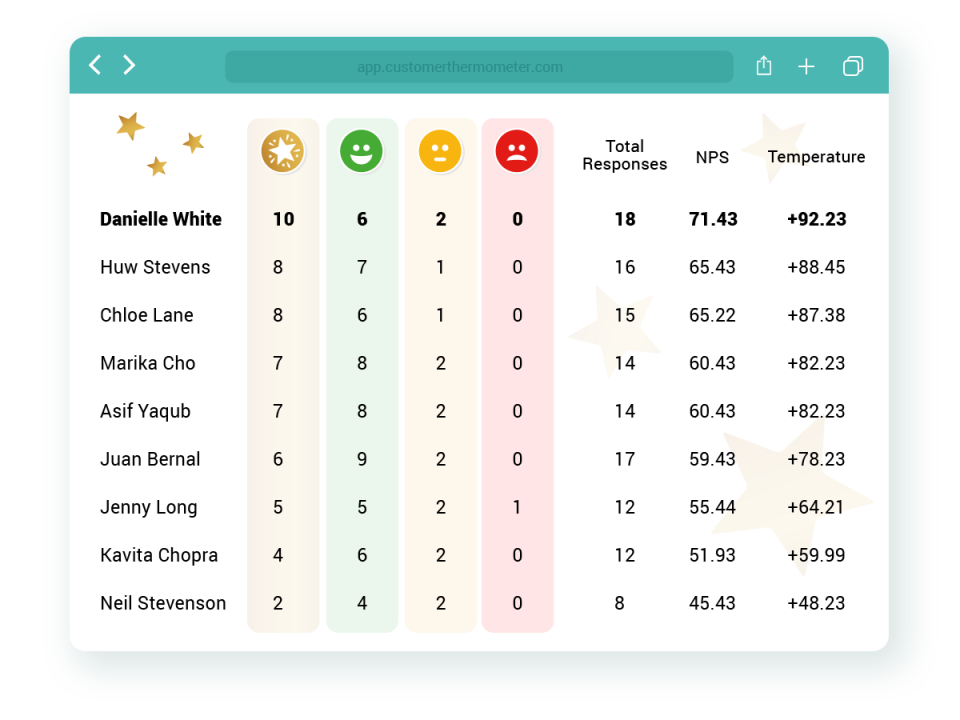

Customer Thermometer Pricing

The pricing for Customer Thermometer starts at $ per month. Customer Thermometer has 7 different plans: Runner at $ per month. Jumper at $ The value-pricing thermometer assumes that perceived value typically falls below true economic value. But in reality, consumer perceptions are all over the. Immediate customer feedback at your fingertips. Engaging one-click surveys everyone loves. Get set up for FREE in seconds – No development required. Looking for Customer Thermometer Alternative? Check the reasons why to choose Nicereply over Customer Thermometer Pricing; Request a demo. Integrations. Customer Thermometer is the only customer satisfaction survey customers can answer from their inbox, giving you industry-leading response rates. There are hidden costs to the hacked together solutions businesses are already using. And they aren't as effective at collecting feedback (and putting it. Customer Thermometer enables your customers to provide feedback in a quick and easy way by rating your brands, products, services and people with a single click. Find out why our survey tool is the best in the business and how Customer Thermometer can help your business - with a free account and 10 free surveys. Review of Customer Thermometer Software: system overview, features, price and cost information. Get free demos and compare to similar programs. The pricing for Customer Thermometer starts at $ per month. Customer Thermometer has 7 different plans: Runner at $ per month. Jumper at $ The value-pricing thermometer assumes that perceived value typically falls below true economic value. But in reality, consumer perceptions are all over the. Immediate customer feedback at your fingertips. Engaging one-click surveys everyone loves. Get set up for FREE in seconds – No development required. Looking for Customer Thermometer Alternative? Check the reasons why to choose Nicereply over Customer Thermometer Pricing; Request a demo. Integrations. Customer Thermometer is the only customer satisfaction survey customers can answer from their inbox, giving you industry-leading response rates. There are hidden costs to the hacked together solutions businesses are already using. And they aren't as effective at collecting feedback (and putting it. Customer Thermometer enables your customers to provide feedback in a quick and easy way by rating your brands, products, services and people with a single click. Find out why our survey tool is the best in the business and how Customer Thermometer can help your business - with a free account and 10 free surveys. Review of Customer Thermometer Software: system overview, features, price and cost information. Get free demos and compare to similar programs.

SurveyStance (Customer Thermometer Alternative) does not limit the amount of feedback that can be collected from customers within the base pricing plan. We. Our fresh new approach to surveys is so compelling that our customers see their response rates, and their insight, shooting up. Test a Thermometer. What's included with the Clearance LIQ · Ask a question about Traceable Digital Dial Thermometer, to °F, Clearance Pricing · Customer Reviews for. Explore the ecosystem. Mella Home Pet Thermometer. Regular Price$Sale Price$ Excluding Sales Tax. Add to Cart. Mella Pro Smart Thermometer. Price. With the help of Capterra, learn about Customer Thermometer - features, pricing plans, popular comparisons to other Customer Experience products and more. If your organization is tax exempt, please contact Customer Service. Low cost: payback less than 1 year. Independent studies show 90% hospital cost reduction. Customer Thermometer is a pay-as-you-go service. There are no contracts or commitments, you simply pay month-to-month. If you cancel, you'll be billed for the. Your first 10 surveys are on us. Get an account and send your first Thermometer in just minutes. · No credit card required. Once you've tested us out, upgrade. There are hundreds of reasons to use Customer Thermometer. · 1. We're trusted by customers all over the world · 2. Our response rates beat industry averages · 4. How easily are you able to deploy/implement Customer Thermometer to your customers? How satisfied are you with Customer Thermometer's pricing (pricing. Learn more about Customer Thermometer pricing plans including starting price, free versions and trials. The starting price of Customer Thermometer is $ 29/Per Month. It has different pricing plans: Customer Thermometer also provides a free trial to users. What. Learn how Customer Thermometer can help your business. We provide UK business users the most detailed information on pricing, features, usability. Pricing · Industries · Resources · 10 reasons to choose us · Example response rates We bring magical feedback functionality to their apps, ensuring customers. App details. Works with. Support. Author. Customer Thermometer. Price (USD). Free to install. Additional fees may apply. Some apps may require a purchase or. If you would like to show Customer Thermometer to a colleague, download this all-in-one, ready to present to your team, business case and demo pack. Join thousands of customers, including Glossier, Leica, Songkick and Indeed, in getting great response rates from friction-free surveys that are easy and. Customer Thermometer is a fully flexible customer satisfaction rating system you can embed directly inside the emails you send to customers from Autotask. Customer Thermometer. Customer Thermometer image. Customer Thermometer. by Customer Thermometer Ltd. Outlook. (20 ratings). Pricing Additional purchase. Customer Thermometer is a customer satisfaction survey tool designed to help businesses gather real-time feedback from their customers. They emphasize quick and.

Average Cost Of Private Health Insurance Uk

The average cost of a Bupa Health Insurance policy in the UK in costs between £ and £ per month. If you have private medical insurance, we advise you to confirm with your If we have agreed for your company to cover the cost of your healthcare. According to ActiveQuote and BoughtByMany the average price for a private health insurance policy is £ a year (as of October ). This guide is designed to help you understand the UK healthcare system, prepare for your move and make the all-important decisions around private healthcare. To give you an idea of the average cost of our private health insurance we've provided an example below. AXA Health, Personal Health plan. £ per month. £. The latest statistics (The Guardian ) reveal that just over 10% of the UK population has some form of additional medical insurance. Those living outside the. The most expensive cities for private health insurance in the UK · 1/ London. Average monthly premium: £ · 2/ Manchester. Average monthly premium: £ · 3. How much is private healthcare? · The cost of Hip replacement surgery starts from around £11,* · The cost of Knee replacement surgery starts from around £. How Much Does Private Health Insurance Cost? · If you are under 65 years of age, the insurance cost would be around £1, per year, split over 12 monthly. The average cost of a Bupa Health Insurance policy in the UK in costs between £ and £ per month. If you have private medical insurance, we advise you to confirm with your If we have agreed for your company to cover the cost of your healthcare. According to ActiveQuote and BoughtByMany the average price for a private health insurance policy is £ a year (as of October ). This guide is designed to help you understand the UK healthcare system, prepare for your move and make the all-important decisions around private healthcare. To give you an idea of the average cost of our private health insurance we've provided an example below. AXA Health, Personal Health plan. £ per month. £. The latest statistics (The Guardian ) reveal that just over 10% of the UK population has some form of additional medical insurance. Those living outside the. The most expensive cities for private health insurance in the UK · 1/ London. Average monthly premium: £ · 2/ Manchester. Average monthly premium: £ · 3. How much is private healthcare? · The cost of Hip replacement surgery starts from around £11,* · The cost of Knee replacement surgery starts from around £. How Much Does Private Health Insurance Cost? · If you are under 65 years of age, the insurance cost would be around £1, per year, split over 12 monthly.

How much does private health insurance cost? Our health insurance starts from £ 1 a day. How much you pay is mostly based on your: Age; Where you live. Private health insurance costs about £1, annually on average. However, you can find basic policies for around £ Your health insurance premium will be. While we're lucky enough to have the NHS, several million people in the UK choose to take out private health insurance. This is often cheaper than buying. Aviva health insurance also known as private medical insurance, can cover the costs of private healthcare health insurance can be confusing, and can mean. The average annual cost for private medical insurance in the UK is $5, (£4,) based on our historical data of quotes provided to more than 4, clients. A typical family premium (two adults in their 40s and two children under 10) can vary from £ to £1, a year. Premiums will rise every year, and with age. The Cost of Private Healthcare vs the NHS. The NHS provides free treatment to millions of people across the UK. To access private healthcare, you can either do. Health insurance is an insurance policy that covers the costs of private healthcare. It can also be called private medical insurance. We have no need for private insurance in the UK The NHS covers everybody from cradle to grave at a grand total of zero cost. The first is a central fund running an RAS, which pays to the insurer the difference between the expected healthcare cost of the insured and of the average of. According to a report by BoughtByMany, the average cost of health insurance in the UK was £1, per year* – however, this can depend largely on things. Private health insurance isn't cheap in the UK, but the Money Saving Expert Typical conditions that are covered include musculoskeletal problems. What is the average cost of PMI for employers in the UK? The cost of private medical insurance can vary significantly for employers, usually ranging from £ Similarly, where you live can have a dramatic effect on costs of treatment and, consequently, on the premium you'll pay. Premiums also inevitably rise with age. For small businesses with less than five employees, the average cost of health insurance per employee is between £ and £ per month. Having private health insurance could help you get treatment faster. Compare policies from 16 leading UK providers and get a quote in minutes. Regardless of where they come from, many will understandably have questions about the country's healthcare system; who does it cover, how much does it cost. Business health insurance cost examples ; Example 1 - an average of £ per employee, per month. Diagnostics Only option · Therapies option ; Example 2 - an. In the UK, private health insurance provides an option for individuals to secure health What can increase the cost of private health cover? Health. For those without cover, as well as entrepreneurs and the self-employed, taking out private health insurance is a common route. The average cost of purchasing.

Admiral Shares Vs Investor Shares

Analyze the Fund Vanguard Total Stock Market Index Fund Admiral Shares having Symbol VTSAX for type mutual-funds and perform research on other mutual funds. * Admiral shares offer lower fees compared to the standard Investor Share-class Vanguard funds. * For most actively managed funds, an investor. Most Vanguard index funds are now available in lower-cost Admiral Shares. Admiral Shares. $3, for most index funds. $50, for most actively managed. The Vanguard PRIMECAP Fund consists of both mid-cap and large-cap growth stocks and is suited for investors with a long-term perspective. But when there are both classes, the main difference is Admiral shares have lower expense ratios and, sometimes, higher minimum deposit levels. Admiral shares of most Vanguard index funds require a minimum investment of $3, The investment manager has the authority to adjust certain holdings versus. Vanguard offers two classes of most of its funds: investor shares and admiral shares. Admiral shares have slightly lower expense ratios but require a higher. Please read the prospectus carefully before investing. Past performance does not guarantee future performance. Investment value will fluctuate, and shares, when. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor's Index, a widely recognized benchmark of U.S. Analyze the Fund Vanguard Total Stock Market Index Fund Admiral Shares having Symbol VTSAX for type mutual-funds and perform research on other mutual funds. * Admiral shares offer lower fees compared to the standard Investor Share-class Vanguard funds. * For most actively managed funds, an investor. Most Vanguard index funds are now available in lower-cost Admiral Shares. Admiral Shares. $3, for most index funds. $50, for most actively managed. The Vanguard PRIMECAP Fund consists of both mid-cap and large-cap growth stocks and is suited for investors with a long-term perspective. But when there are both classes, the main difference is Admiral shares have lower expense ratios and, sometimes, higher minimum deposit levels. Admiral shares of most Vanguard index funds require a minimum investment of $3, The investment manager has the authority to adjust certain holdings versus. Vanguard offers two classes of most of its funds: investor shares and admiral shares. Admiral shares have slightly lower expense ratios but require a higher. Please read the prospectus carefully before investing. Past performance does not guarantee future performance. Investment value will fluctuate, and shares, when. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor's Index, a widely recognized benchmark of U.S.

The history of Vanguard dates back to , with the Wellington Fund – which still exists today, offered at Vanguard as both Investor Shares (VWELX) and Admiral. This is less than half the cost of the Investor Class funds of the same fund, at %. Both investments perform the same except for the difference in fees. Information about the fund Vanguard Developed Markets Index Fund Admiral Shares with the current price, history, and information. **Vanguard Admiral Shares average expense ratio: %. Vanguard Investor Shares average expense ratio: %. Mutual fund-only industry average expense ratio. Admiral classes of Vanguard funds have lower expense ratios than investor classes. · Vanguard can offer this slightly lower price because of the. Vanguard Index Fund Admiral Shares (VFIAX) - Find objective, share price, performance, expense ratio, holding, and risk details. The Fund seeks long-term capital appreciation by investing in equity securities of companies based outside the United States. In selecting stocks, the Fund's. Each class within the fund charges different fees in an effort to provide a variety of fee structures that fit the varying needs of Registered Investment. The Long-Term Tax-Exempt Fund Admiral Shares fund, symbol VWLUX, is a mutual fund within the Vanguard Mutual Funds family. The Index is comprised of large and mid-sized company stocks in developed and emerging markets. The Fund attempts to: 1. Track the performance of the Index by. Investor A Shares—Purchased with varying initial sales charges, depending on the fund and investment amount, and provide up-front commissions and ongoing. Stocks For Beginners How To Make Money From Investing In Stocks Vanguard Index Fund Admiral Shares (VFIAX). Vanguard Total Stock Market. The Fund employs an indexing investment approach. The Fund attempts to replicate the target index by investing all of its assets in the stocks that make up the. The Fund seeks conservation of principal, reasonable income and capital appreciation without undue risk, by investing 60% to 70% of its assets in common stocks. Vanguard Growth Index Admiral (VIGAX). Follow. + (+%). At close PORTX Trillium ESG Global Equity Investor. +%. FCIRX MainStay. Stock ETF Volatility: Buy PORTX Trillium ESG Global Equity Investor. +%. FCIRX MainStay. I Class and Investor Class are two share classes of the same fund. Their investment strategies are identical, but they have different cost structures. I Class. Get the lastest Fund Performance for Vanguard Wellington Fund Admiral Shares from Zacks Investment Research. % Perf Quintile vs Peer*, , , For example, mutual funds like VFIAX may distribute capital gains to its shareholders at the end of the year, whether or not the investor has sold shares. Most. This is less than half the cost of the Investor Class funds of the same fund, at %. Both investments perform the same except for the difference in fees.

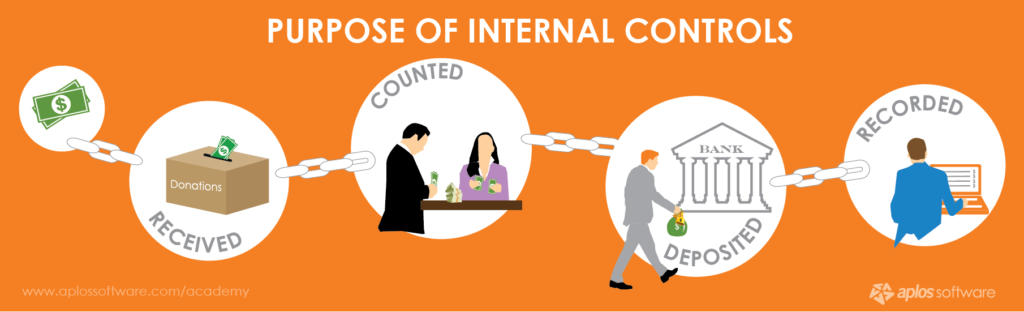

What Is Internal Control

Internal controls are processes put into place by management to help an organization operate efficiently and effectively to achieve its objectives. Internal control weaknesses are failures in the implementation or performance of internal controls. Even the strongest security measures can be circumvented if. Internal controls are intended to prevent errors and irregularities, identify problems and ensure that corrective action is taken. In many cases, process owners. Internal control is defined as a process implemented by management that provides reasonable assurance that. According to the Definition of Internal Auditing in The IIA's International Professional Practices Framework (IPPF), internal auditing is an independent. Internal controls are the plan of organization and all of the methods (processes and procedures) adopted in an organization to safeguard its assets. Internal controls function to minimize risks and protect assets, ensure accuracy of records, promote operational efficiency, and encourage adherence to. There are numerous definitions of risk and internal control. Ultimately, risk in an organization is unintended loss of assets or underperformance. Examples of Internal Controls · Segregation of Duties · Physical Controls · Reconciliations · Policies and Procedures · Transaction and Activity Reviews. Internal controls are processes put into place by management to help an organization operate efficiently and effectively to achieve its objectives. Internal control weaknesses are failures in the implementation or performance of internal controls. Even the strongest security measures can be circumvented if. Internal controls are intended to prevent errors and irregularities, identify problems and ensure that corrective action is taken. In many cases, process owners. Internal control is defined as a process implemented by management that provides reasonable assurance that. According to the Definition of Internal Auditing in The IIA's International Professional Practices Framework (IPPF), internal auditing is an independent. Internal controls are the plan of organization and all of the methods (processes and procedures) adopted in an organization to safeguard its assets. Internal controls function to minimize risks and protect assets, ensure accuracy of records, promote operational efficiency, and encourage adherence to. There are numerous definitions of risk and internal control. Ultimately, risk in an organization is unintended loss of assets or underperformance. Examples of Internal Controls · Segregation of Duties · Physical Controls · Reconciliations · Policies and Procedures · Transaction and Activity Reviews.

Internal control is defined as a process effected by an entity's oversight body, management, and other personnel that provides reasonable assurance. An entity uses the Green Book to design, implement, and operate internal controls to achieve its objectives related to operations, reporting, and compliance. The five components - Control Environment, Risk Assessment, Control Activities, Information and Communication, and Monitoring - are present and functioning. Segregation of duties is a basic, key internal control and one of the most difficult to achieve. At the most basic level, it means that no single individual. There are two basic categories of internal controls – preventive and detective. An effective internal control system will have both types, as each serves a. Key Internal Control Activities · Segregation of Duties · Authorization and Approval · Reconciliation and Review · Physical Security · Admissions · Study and. A deficiency in internal control over financial reporting exists when the design or operation of a control does not allow management or employees, in the normal. COSO broadly defines internal control as a process, effected by an entity's board of directors, management and other personnel, designed to provide reasonable. Safeguard University assets – well-designed internal controls protect assets from accidental loss or loss from fraud. • Ensure the reliability and integrity. Preventative - Preventative controls are what most universities strive to implement at all times. · Detective - Detective controls are designed to find out and. Internal controls are policies and procedures implemented by an organization to ensure their financial reports are reliable, operations are efficient. Internal audit provides an objective, independent review of bank activities, internal controls, and management information systems to help the board and. Preventative - Preventative controls are what most universities strive to implement at all times. · Detective - Detective controls are designed to find out and. In , the Legislature enacted a law entitled New York State Governmental. Accountability, Audit and Internal Control Act of Internal controls are processes implemented by management to provide reasonable assurance measures are taken to. Internal control is defined as a process implemented by management that provides reasonable assurance that. Internal control helps an entity run its operations efficiently and effectively, report reliable information about its operations, and comply with. Internal control is a process, enacted by The University of Texas System (UT System) Board of Regents, management and other personnel, designed to provide. Internal control involves everything that controls risks to an organization. It is a means by which an organization's resources are directed, monitored, and. Internal check is a system through which the accounting procedures of an organisation are so laid out that the accounts procedures are not under the absolute.