filmproducers.ru

Gainers & Losers

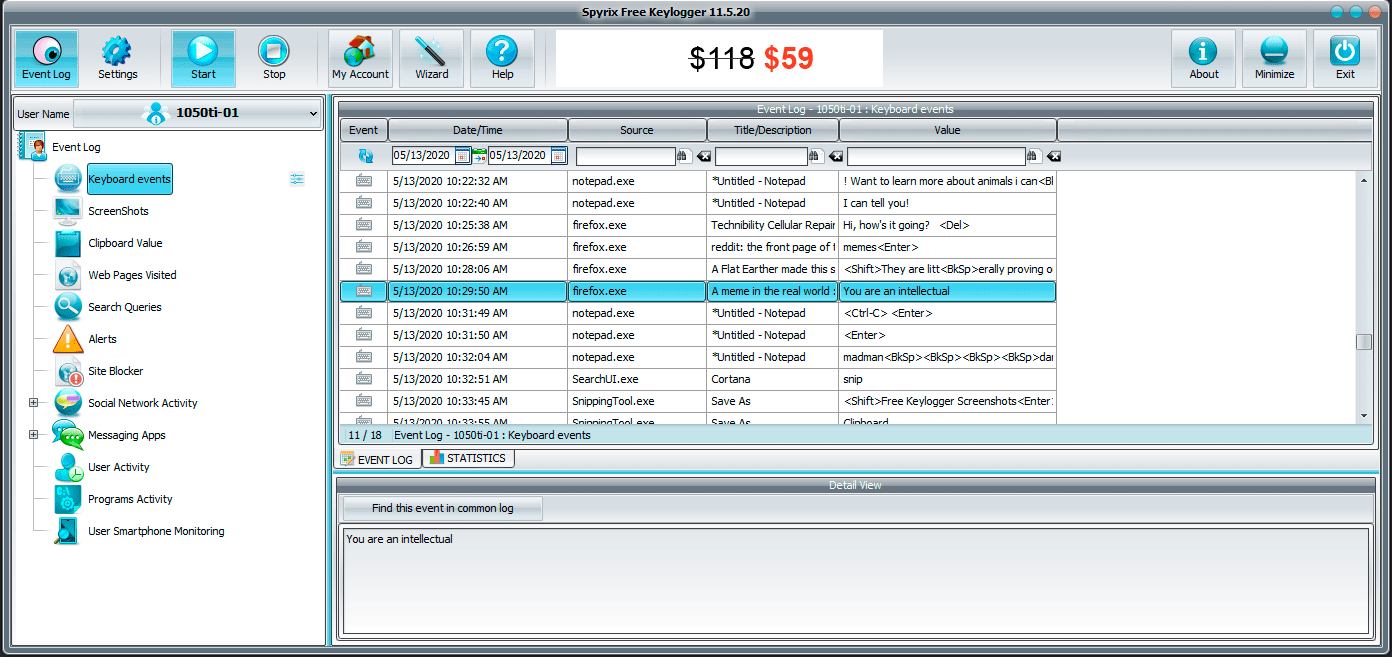

Keystroke Software For Pc

Keystrokes are how you “speak” to your computers. Each keystroke transmits a signal that tells your computer programs what you want them to do. These commands. KeyGhost is software free! How? It has a capacity of up to 2,, keystrokes stored with STRONG bit encryption. (This is approximately , words, or. Ultimate keylogger software for Windows & macOS Watch everything that's happening on your PC while you are away! Use any device, anywhere in the world! Protect your business with keylogger software. Record keystrokes typed by office and remote employees working from PCs, Macs or Terminal Servers. Top 5 Keylogger for Windows 10 · 1. MoniVisor: Best Keylogger Software for Windows · 2. Refog Keylogger · 3. Spyrix: Free Keylogger for Windows · 4. Perfect. A free keylogger safe to download and use is Task Logger. Iit is not blocked like others by Windows defender or Google Chrome, proving that it. Best Keyloggers for Windows. · Spytech SpyAgent Standard Edition · Spyrix Personal Monitor PRO · Refog Personal Monitor. Download Keylogger For Windows - Best Software & Apps · Free KeyLogger. 5. Free. Monitor your computer usage for free · Free Keylogger. Free · LightLogger. Argos Monitoring. Easily record keystrokes, visited websites and screenshots of all PC activity in hidden mode using this advanced keylogger. Keystrokes are how you “speak” to your computers. Each keystroke transmits a signal that tells your computer programs what you want them to do. These commands. KeyGhost is software free! How? It has a capacity of up to 2,, keystrokes stored with STRONG bit encryption. (This is approximately , words, or. Ultimate keylogger software for Windows & macOS Watch everything that's happening on your PC while you are away! Use any device, anywhere in the world! Protect your business with keylogger software. Record keystrokes typed by office and remote employees working from PCs, Macs or Terminal Servers. Top 5 Keylogger for Windows 10 · 1. MoniVisor: Best Keylogger Software for Windows · 2. Refog Keylogger · 3. Spyrix: Free Keylogger for Windows · 4. Perfect. A free keylogger safe to download and use is Task Logger. Iit is not blocked like others by Windows defender or Google Chrome, proving that it. Best Keyloggers for Windows. · Spytech SpyAgent Standard Edition · Spyrix Personal Monitor PRO · Refog Personal Monitor. Download Keylogger For Windows - Best Software & Apps · Free KeyLogger. 5. Free. Monitor your computer usage for free · Free Keylogger. Free · LightLogger. Argos Monitoring. Easily record keystrokes, visited websites and screenshots of all PC activity in hidden mode using this advanced keylogger.

A keylogger, sometimes called a keystroke logger, is a type of surveillance technology used to monitor and record each keystroke on a specific device. Keystroke Spy's keystroke logger allows you to record all keystrokes users type while using your computer. All logged keystrokes are viewable in their raw. Free Keylogger Software by Refog is the top rated monitoring software available. Invisible and undetectable for Windows 10, , 8, 7. Work Examiner keylogger software: you should know what they do on computer! ; Keystrokes, Emails, Chats · Instant Messaging: Windows Live Messenger, MSN. Records all the users activities on Windows computers. Revealer Keylogger combines keystroke logging, screenshot capture, and remote monitoring - all in one app. The AirDrive Keylogger is an innovative ultra-small USB hardware keylogger, only " (20 mm) in length. It can be accessed with any Wi-Fi device such as a. What Is a Keylogger? Keyloggers or keystroke loggers are software programs or hardware devices that track the activities (keys pressed) of a keyboard. Top 5 Keylogger for Windows 10 · 1. MoniVisor: Best Keylogger Software for Windows · 2. Refog Keylogger · 3. Spyrix: Free Keylogger for Windows · 4. Perfect. Iwantsoft Free Keylogger discreetly monitors nearly all activities on a computer by registering every keystroke, capturing the content of the system clipboard. Best Free Keylogger is a free but professional PC monitoring software that allows you to monitor children or employee computer and internet activities. I use benign-key-logger from GitHub, it's great. Very simple script that you can inspect yourself. Gives you output as either txt file, SQLite. A Keystroke Logger, or keylogger, is a type of software that captures and logs what a user on your computer types on the keyboard - typically without the. Keystroke logging, often referred to as keylogging or keyboard capturing, is the action of recording (logging) the keys struck on a keyboard. User mode keyloggers use a Windows application programming interface (API) to intercept keyboard and mouse movements. GetAsyncKeyState or GetKeyState API. Top downloads Keyloggers for Windows · Free KeyLogger. Monitor your computer usage for free · LightLogger Keylogger. A Tool that Records All Your Web Activity. The term keylogger, or “keystroke logger,” is self-explanatory: Software that logs what you type on your keyboard. However, keyloggers can also enable. Monitors any kind of user activity on your computer letting you know what other users are doing on the device when you are not present. The keylogger keeps. A keylogger is a hardware device or a software application that runs silently on a computer and logs the keystrokes typed by a user on the keyboard. Hardware. All things considered, LightLogger Keylogger ranks among the best keylogger program for Windows 10 and Vista. Designed to be as versatile and as silent as.

Beneficiary Of 401k Options

If you are the beneficiary of a deceased spouse's (k), you can decide to leave the money in the spouse's retirement account, rollover the money into an IRA. beneficiary designation on file with each, different plan provider. In NC (k) and NC Plans, Tax-deferred supplemental retirement plans for NC. When you inherit a (k), withdrawal options depend on whether you are a spouse or a non-spouse beneficiary. See how naming a charitable beneficiary to your retirement plan works and How to designate a charity as the beneficiary of an IRA or (k). When. Members must select beneficiaries for their TCRS, (k), and (b) plans separately, even if the member selects the same beneficiary for all plans. And inside those non-retirement and retirement accounts are investments—things like mutual funds, stocks, and bonds. These accounts—and the investments. You have four options as a surviving non-spouse beneficiary: · 1. Transferring to an inherited IRA · 2. Take a lump-sum distribution · 3. Withdraw funds over a 5. The withdrawal options for beneficiaries that inherited from an original depositor that passed away on or after. Unless a spouse signs a waiver, they must be named as the plan holder's beneficiary. If a waiver is signed or the decedent is not married, one or more other. If you are the beneficiary of a deceased spouse's (k), you can decide to leave the money in the spouse's retirement account, rollover the money into an IRA. beneficiary designation on file with each, different plan provider. In NC (k) and NC Plans, Tax-deferred supplemental retirement plans for NC. When you inherit a (k), withdrawal options depend on whether you are a spouse or a non-spouse beneficiary. See how naming a charitable beneficiary to your retirement plan works and How to designate a charity as the beneficiary of an IRA or (k). When. Members must select beneficiaries for their TCRS, (k), and (b) plans separately, even if the member selects the same beneficiary for all plans. And inside those non-retirement and retirement accounts are investments—things like mutual funds, stocks, and bonds. These accounts—and the investments. You have four options as a surviving non-spouse beneficiary: · 1. Transferring to an inherited IRA · 2. Take a lump-sum distribution · 3. Withdraw funds over a 5. The withdrawal options for beneficiaries that inherited from an original depositor that passed away on or after. Unless a spouse signs a waiver, they must be named as the plan holder's beneficiary. If a waiver is signed or the decedent is not married, one or more other.

Options for beneficiaries · 1. "Disclaim" the inherited retirement account · 2. Take a lump-sum distribution · 3. Transfer the funds into your own IRA · 4. Open a. If you are married, federal law says your spouse* is automatically the beneficiary of your k or other pension plan, period. You should still fill out the. You can elect or change your (k) Plan beneficiaries online anytime on Fidelity's NetBenefits site. Simply sign in to your account and then click the "Your. If you haven't retired from your plan, you only have beneficiaries. If you are retired, you could have both. Beneficiary: Receives a lump-sum payment. When you. Your primary beneficiary is your first choice to receive retirement benefits. You can name more than one person or entity as your primary beneficiary. If you are married, (k) beneficiary rules typically consider your spouse as the default beneficiary of your account. Most (k) plans will not transfer. First, it is important to mention that beneficiaries named on a (k) plan inherit their assets, even if stipulated in a will that it goes to. 3 steps to inherit a Fidelity IRA as a beneficiary · 1: Notify us of a death · 2: Open an inherited IRA · 3: Inherit the money · Call us at The information below will help you understand a spouse's options to elect survivor benefits from a tax-deferred retirement account, such as a (k). Click “Beneficiary Summary” under My Beneficiaries on your home page. · Review your beneficiary designations. · Click the blue link under the "Plan Description". Any beneficiary can close an inherited (k) and take a lump-sum distribution, without penalty, at any age. However, they will pay income tax on the withdrawal. The retirement plan rules specify that for a married participant, the default beneficiary is his or her spouse. It is possible to name someone else; however. If you're married, your spouse is probably going to be your primary beneficiary. For example, employer-sponsored retirement plans generally require you to. Spouses get more options than other beneficiaries, and may be able to put off taxes on retirement account funds for longer. · Your Options When You Inherit Your. Non-spouse beneficiaries of a (b) plan have the option of moving the assets to an inherited (b), roll over to an inherited IRA or take a lump-sum. When a person dies, his or her k becomes part of his or her taxable estate. However, a beneficiary generally won't have to wait until probate is completed to. NO, as long as the beneficiaries are properly designated. Keep in mind that if the will stipulates anything about such accounts, the named beneficiaries take. A profit-sharing plan that does not require spousal consent for anything but beneficiary designations may have transferred assets from a money purchase pension. Only surviving spouses can roll over inherited retirement assets into their own IRAs. If you do this, the money is treated just like your own IRA. If you are married, federal law says your spouse* is automatically the beneficiary of your k or other pension plan, period. You should still fill out the.